How to keep pace with the rapidly changing supply chain environment

Supply ChainArticleSeptember 12, 2023

Supply chain risks are changing at a rapid pace, with implications for risk management and insurance coverage, according to Camilla Chandra, Zurich’s Head of Marine EMEA, Commercial Insurance and Björn Hartong, Global Head of Marine, Security and Supply Chain Risk Engineering, Zurich Resilience Solutions.

Supply chain risks and exposures are changing faster than many people realise. Post-pandemic supply chain disruption may be easing, but a host of drivers are re-drawing the supply chain landscape. Geopolitical trends, ESG considerations, and the drive for greater resilience are changing where companies produce and source goods and how they transport them.

New locations

Every company has its own supply chain strategy, but as organisations look to build more resilient supply chains and respond to macrotrends, the supply chains footprint is changing. Companies are looking to diversify, engaging with new suppliers, often in new locations, while some organisations are relocating production closer to home, or at least to countries that are less diverse to them.

Post-pandemic, the US and Europe have become wary of an overreliance on overseas suppliers in critical sectors like green technology and semi-conductors, encouraging a trend for re-shoring or friend-shoring. As companies seek to reduce their reliance on China, many are diversifying to South East Asia, as well as India, Mexico, Canada, North Africa, and Eastern Europe. According to a 2022 report from Gartner, 74% of companies have made changes to the size and number of locations in their supply chain network in the past two years, and just over half have increased the number of locations.

As companies diversify supply chains and consider new locations, they encounter a wide range of new or different risks to those in existing supply chains. Location is a key aspect of risk assessment, as natural hazards, the quality of infrastructure, safety and risk management culture, skill and labour, regulation and legal regimes, vary widely by country. When moving locations company may unwittingly expose themselves to a new set of risks.

The Zurich Risk Room chart above illustrates the aggregated overview of the complex risk landscape across both physical and governance/societal dimensions mentioned in this article and offers an overview of the high spread of risk levels between some of the countries many are diversifying to as an alternative to China.

Source: Zurich Risk Room. Retrieved on September 1, 2023.

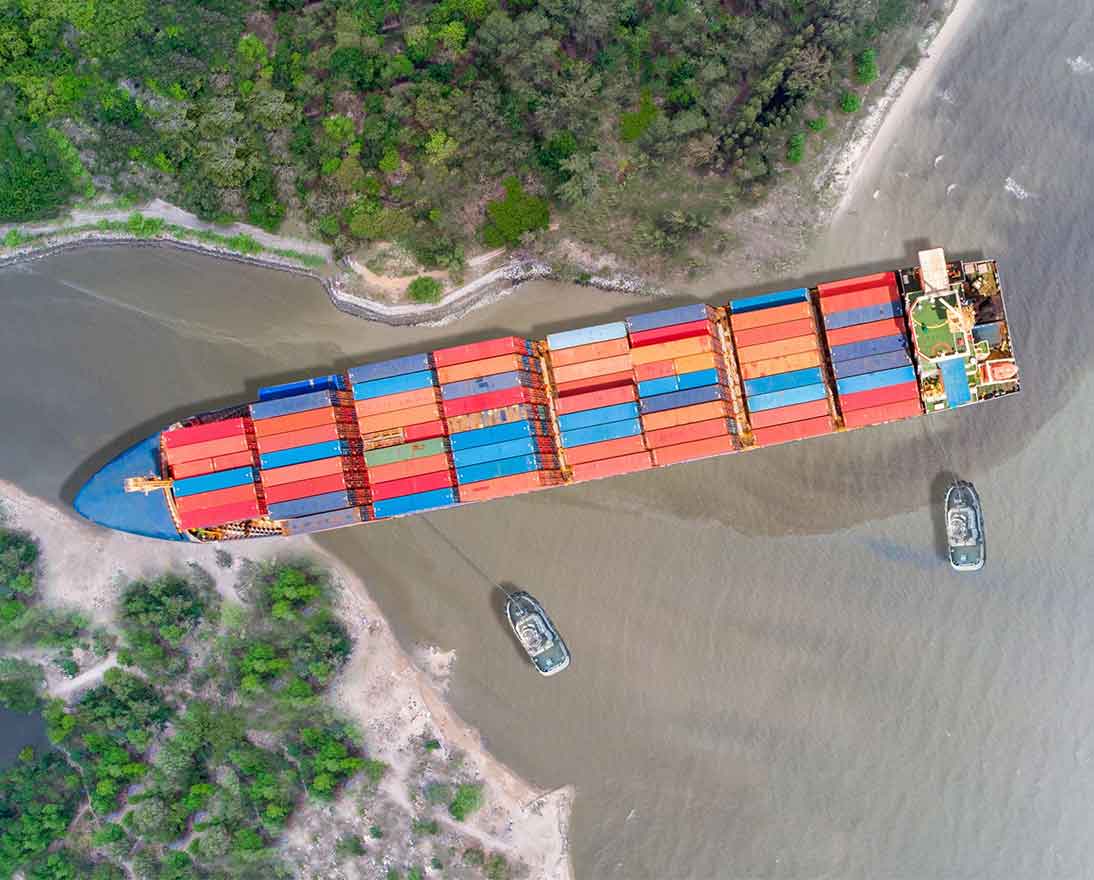

Higher values in storage

Another consequence of changing supply chain models has been the increasing value of goods shipped both in transit and in storage, and changes in the risk profile due to new logistics partners and routes and types of goods being sourced.

As operators seek more resilience in their supply chains, there has been a shift from a “just in time” to a “just in case” model which is increasing demand for warehousing along the supply chain. At the same time, post-Covid 19 labour shortages, delays and capacity constraints continue to affect key points along the supply chain, such as road transport, shipping, ports and government departments like customs and border control, meaning goods are held in storage or transit for longer.

With warehouse capacity in short supply, and with ongoing labour shortages, the quality and security of storage facilities may not always be up to scratch, increasing the risks of loss or damage. Increased inventory and goods in storage is also likely to mean increased exposures, which in turn affects insurance limits and deductibles. In addition, the return of higher inflation since the pandemic has significantly increased the value of goods in storage and transit.

Cargo theft on the rise

In addition to the ever-present threat to goods in storage and transit from fire and natural hazards, theft has become of increasing concern, as higher values make certain commodities such as metals and goods like mobile phones and catalytic converters, more attractive. Freight theft from supply chains in the Europe, Middle East & Africa surpassed €12 million in May 2023 alone, with 936 cargo thefts in 33 countries across the region, according to the TAPA EMEA Intelligence System (TIS).

The problem of cargo theft from trucks, ports and warehouses is likely to persist, if not increase, with the cost-of-living crisis, while criminal gangs are proving more resourceful and sophisticated. Raw materials and machinery are short in supply, which further incentivises thefts of these goods, which are then sold back into the market. This heavily disrupts supply chains as products cannot be produced without these materials.

ESG to drive transparency

An increasingly important driver for supply chains comes from environmental, social and governance (ESG). Sustainability, decarbonisation, and human rights concerns will increasingly influence where companies source materials and products, as well as dictate who they will do business with.

Increasing ESG legislation, such as the EU' Corporate Sustainability Due Diligence Directive will require companies to monitor and report on ESG factors within supply chains in order to implement practices to mitigate any impacts from their operations. For example, Germany’s Supply Chain Due Diligence Act requires companies to monitor supply chains for human rights violations and ensure that partners are not causing environmental degradation across their supply chain. This is in addition to growing pressure from investors and banks for ESG disclosure and more sustainable supply chains.

ESG disclosure should help increase supply chain transparency, as well as investments in real time data analytics and technology. While positive for risk management, data alone will not prevent supply chain disruption. Companies need to be able to act on information, especially when it comes to high value or critical materials and components.

Risk management

With so many moving parts, and often conflicting drivers, understanding the risks within the supply chain has never been so important. Yet, the decades old trend of outsourcing has left many organisations with less oversight and control of their supply chains, while inhouse procurement and logistics departments have been depleted.

Post-pandemic, more and more companies realise the value in having robust supply chain risk management, even regarding it as a competitive advantage. According to Moody’s, almost 70% of businesses it surveyed are ramping up their investment in supplier risk detection. This all points to a vital role for risk professionals in helping organisations better understand the risks and dependencies in their evolving supply chains, and how they can mitigate and protect against losses.

While supply chains are clearly changing at a pace, this is very much business as usual for insurers. Many of the risks affecting supply chains, from natural hazards to fire and theft, have been present throughout time, and well catered for by traditional marine insurance products.

Above all, changing supply chain risk will require greater dialogue. Increasingly companies need support navigating these challenges and insurers are well positioned to assist and offer insights, from understanding the evolving supply chain risk landscape to assessing the risks of new locations. Companies are therefore encouraged to start a conversation with their insurers at an early stage when considering changes to their supply chains to gain a better understanding of these potential impacts.

At Zurich, underwriters are increasingly dealing with requests from customers with new supply chain exposures while risk engineers at Zurich Resilience Solutions are busy helping customers assess their supply chain risks and advising on new risks and mitigation measurements. Zurich is also developing tools to help customers assess their supply chains, including a self-assessment tool that identifies critical areas for risk mitigation and loss prevention.

Originally published in Commercial Risk on September 12, 2023