The Value of Investing in Services

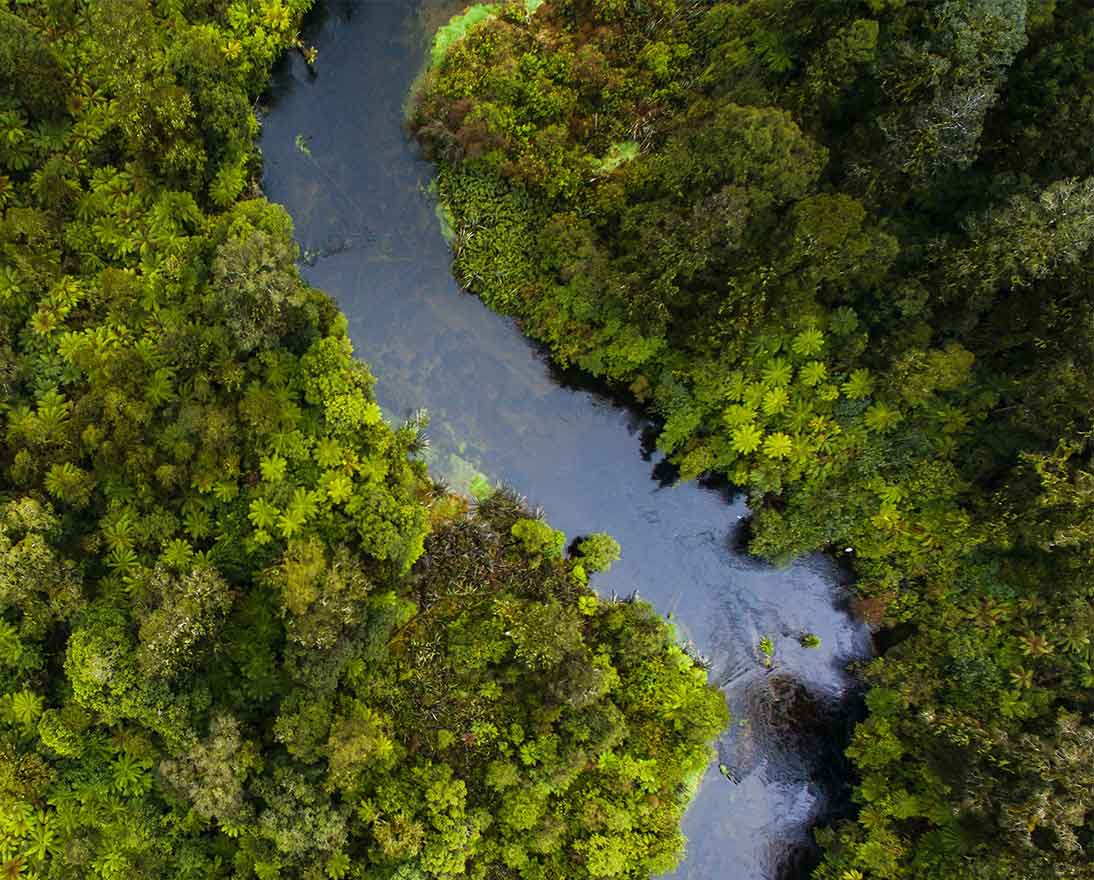

SustainabilityPodcastJanuary 27, 2022

Spain’s insurers tackle tough risks with broker collaboration and technology

After years of large losses, commercial insurers in Spain are being more selective about what they cover, while helping companies improve their risk profiles to make them more attractive to the insurance market, a panel of experts from Zurich Resilience Solutions points out.

Coverage costs continue to rise, and insurers have reduced their capacity for many exposures, particularly for those in the food, chemical and waste treatment businesses, according to Josep Maria Nogueras, Customer Manager, Zurich Resilience Solutions Spain. “The direct consequence is that many companies from different industrial sectors are having a lot of problems finding suitable insurance solutions,” he added.

Josep Maria Nogueras was a panelist in a recent podcast that also featured two other executives from Zurich Resilience Solutions Spain: Jose Luis Garcia, Director, and Karin Casola, Relationship and Sales Manager.

Insurers have had no choice but to reduce capacity on many risks in Spain as large claims piled up, said Nogueras. “The risk of having big losses that could have a high impact on financials had to be minimized, and the only solution was reducing capacity for certain activities or types of construction,” he continued.

Poor construction is common in Spain, Nogueras noted. Buildings that were cheap, light and easy to build can create fire exposures, he explained, and it is “quite common” to find warehouses and other structures built this way.

Working with brokers

All of this leaves brokers with the challenge of trying to place poor quality risks with insurers that are increasingly shunning such exposures, Nogueras noted. To help change that, Zurich is working with intermediaries to help improve the quality of risks and make it easier to find insurers that will cover them.

In Spain, Zurich takes advantage of technology in its work with brokers to improve risk quality.

Brokers have an opportunity to support small and medium-sized companies that have basic risk management structures in place, José Luis García said. “We will collaborate with brokers to improve their capabilities so they can use our technology and tools to assess and provide risk insights to companies that don’t have proper support.”

“Making use of extensive data analysis, we are able to understand how property claims develop,” said García. Hundreds of thousands of risk assessments based on established benchmarks can pinpoint where claims are likely and identify standards for managing potential losses, he added.

For example, Zurich recently completed an artificial intelligence project to determine the root cause of 22,000 property claims, García noted. “Through machine learning and rule methods, we have extracted information from loss adjuster reports based on geography, activity, exposures and segments. The result is a gem of data analytics that supports our work to provide the best solutions to our industries,” he said.

“We have developed technology, together with state-of-the-art partners, to predict fires, machinery breakdown and climate change claims, among others,” García confirmed.

Innovative solutions

Along with AI, the Internet of Things is a tool being used to limit losses, according to Karin Casola.

“We had a customer from the hotel industry who suffered water damage frequently, and by installing plug and play sensors, we were able to detect micro leakage and prevent losses,” she said. “This not only helped the customer improve their insurance conditions, but also minimize costs and become more sustainable.”

“We have also developed solutions for companies that are not protected by insurance due to poor risk quality or high exposure,” García pointed out. After an analysis based on a large number of assessments of activities, work can be done to improve risk quality and make the company more attractive to insurers, he explained.

“Today, that is the most requested solution by our brokers and customers in the Spanish market,” García said.

Targeting emerging risks

Technology also plays a big role in identifying and managing emerging risks such as those related to climate change, the supply chain and cybercrime, the panelists pointed out.

“Those risks are burning issues and, again, through data analytics and AI it’s possible to understand their evolution,” said Nogueras.

Climate risks are particularly important to address because they have been “massively overlooked in the past and are responsible for many claims,” Nogueras remarked. Using AI and data analytics, a customer can “make the right decisions to be more resilient,” he said.

“Supply chain protection will also be a challenge,” Nogueras said. “We are experiencing shortages of certain raw materials and products - for example, microchips in the automotive industry - and the price of other raw materials is increasing very quickly. Properly assessing supply chains can certainly make the difference so that decisions can be made within a reasonable timeframe” to protect the supply chain, he added.

“When we talk about sustainability, we must not only consider environmental sustainability, but also human, social and economic sustainability,” Nogueras emphasized. “The idea is to identify and manage how businesses impact people and, hence, society.

“Companies have a broad responsibility,” he added, and should be prepared to meet standards around human rights, fair labor practices, diversity and equity, among others.

Google Podcasts

Google Podcasts Apple Podcasts

Apple Podcasts Spotify

Spotify