My Zurich API Connector

Let's connect by going fully digital to seamlessly integrate all your risk and insurance information into your risk management information system or broking platform.

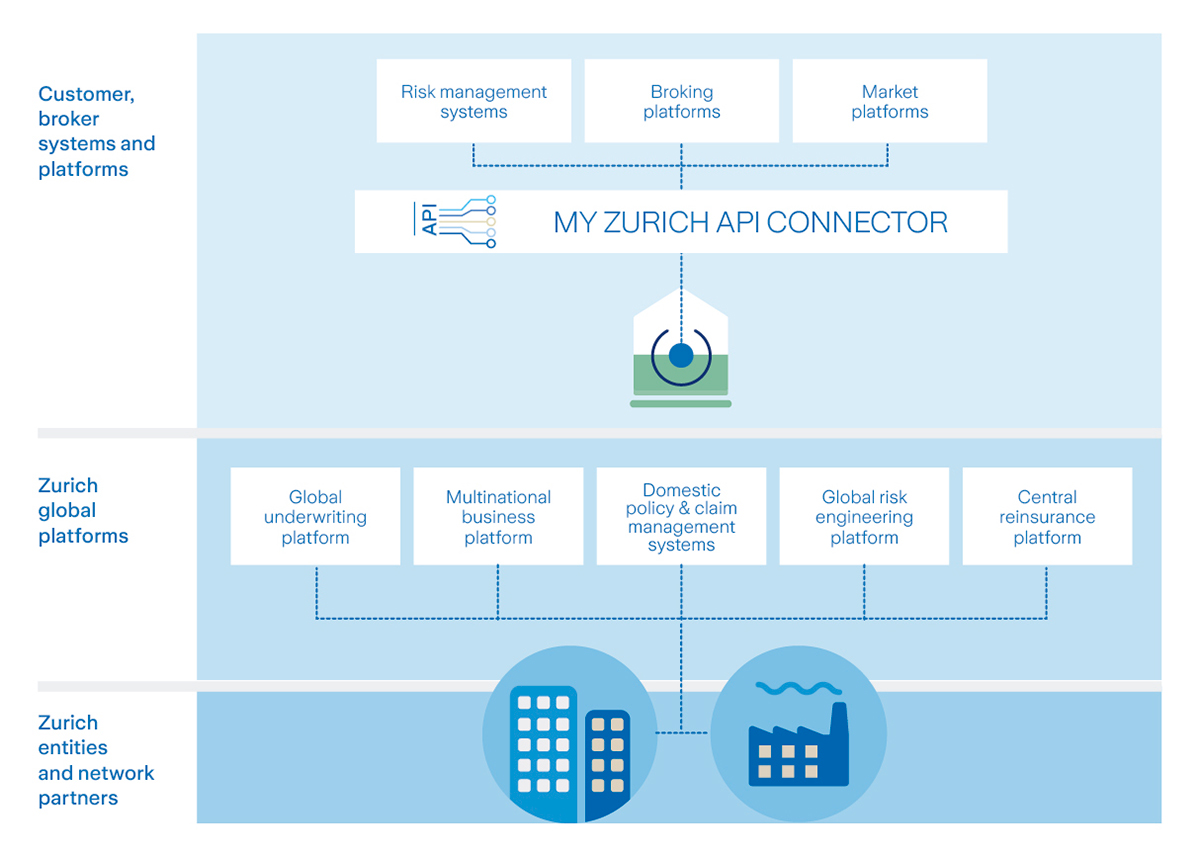

An integrated, digitized approach gives you the transparency and control you need to manage your risk and insurance data effectively and efficiently. By directly connecting your risk management information system or broking platform to our global systems through the My Zurich API Connector, you can access and share data and documents seamlessly and in real-time – enhancing your risk management processes.

Freeing up your teams to focus on more strategic tasks, our API solution makes managing multinational and domestic businesses seamless, sustainable, and smart with secure data sharing. We support you throughout onboarding, so you can connect to our systems effortlessly and with confidence.

The benefits of My Zurich API Connector

Connecting your risk management information system or broking platform with our global systems using My Zurich API Connector

What data is available through the API?

Policy administration

- Program

- Policies

- Premium payments

- Policy documents

- Property location exposure*

- Covers, limits & deductibles

- Policy comments*

- Premium allocation

* supports also bidirectional exchange

Claims

- Claims

- Claim bookings

- Claim reserves

- Claim documents

Risk engineering

- Locations

- Risk gradings

- Loss scenarios

- Risk improvement actions*

- Visit schedules

- Risk engineering documents

* supports also bidirectional exchange

Captive

- Captive premiums

- Captive claims

Integrating My Zurich's coverage and premium data into Marsh Global Connect has greatly improved data quality and efficiency. This API connection allows our teams to spend less time gathering information from various sources and formats, enabling them to focus on delivering better, data-driven advice to clients.

With API, almost all risk engineering data points are integrated into our risk management information system. I am now able to click a button and easily run a report with our most up-to-date risk engineering visits. We also track our claims within our RMIS, so we are able to easily cross reference risk engineering visits and improvement actions to claims activities.

My wish for collaborating with insurance carriers in future must include technically an automated data exchange… An API to the insurance data… would lead to efficiency gains and cost savings. Error prone manual data transfers or misinterpretations would be minimized.

In the past we have spent numerous hours gathering, sending and sorting data. With API we no longer need to clean the data. Instead, it automatically feeds into our risk management system in real time. We can then, without a time-consuming exercise, share accurate data with various stakeholders.

Putting you in control of your risk

My Zurich provides a centralized, user-friendly self-service solution that ensures you make informed decisions quickly, streamlining and optimizing your processes along your risk management and insurance journey. With real-time access to critical data, My Zurich offers powerful tools to manage your insurance programs, track risk information, and stay compliant across multiple regions and jurisdictions.