Economics & Markets

Macroeconomics and movements in financial markets impact many aspects of our lives. Having a well-informed view of what could transpire can help mitigate the risks we face and uncover profitable opportunities.

Monthly Key Points: February 2026

04:47 min

A short monthly video that gives our take on the three most important developments from an economic & market perspective and is designed to support our Investment Insights publication.

Recent publications

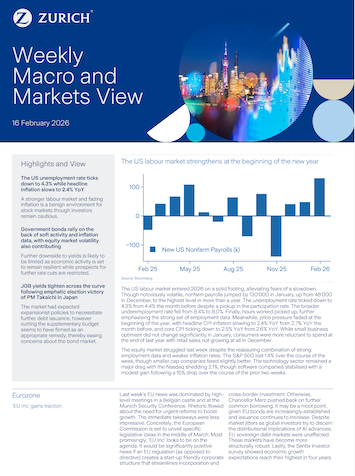

February 16, 2026

Weekly Macro & Markets View, Week 8

Read the latest insights and views

February 13, 2026

Topical Thoughts

The Widowmaker

February 03, 2026

Monthly Investment Insights

The broadening rally has further to run

Explore our publications

Weekly Macro & Markets View

Designed to give clear interpretation of the previous week’s macroeconomic and financial market developments. This publication represents how Zurich sees the financial landscape evolving on a week-by-week basis.

Monthly Investment Insights

Structured to give a succinct view of the investment outlook and economic prospects for the coming months. Focus is on key developments from an investment perspective, with a tactical view presented on the major asset classes of equities, credit and government bonds.

Inflation Focus

A quarterly publication, conveying the most likely outlook for inflation over the subsequent 12-24 months. Global and regional views are provided, detailing the driving forces behind the outlook. Point forecasts are offered for the major coverage areas, with short-term moves and pressures also identified.

Topical Thoughts

Investigative research on specific issues that affect the business environment, with expert thoughts and opinions provided on an ad hoc basis.

Economic and Market Outlook

With a 12 months focus, this publication is designed as a reference document for multiple user groups. It is segmented by region and provides in-depth coverage of both economic and financial market fundamentals, as well as the underlying trends that are observed.

Mid-Year Outlook

An update on the Economic & Market Outlook is provided, gauging developments and projecting how the months ahead are likely to unfold.

Videos and Podcasts

To compliment some publications, a series of short videos and, in the case of Topical Thoughts and the Economic and Market Outlook, more detailed podcasts are available.

Our newsletter

Get regular insights

To keep abreast of global developments, please subscribe here: