The digital tools you need to protect your financial future

Future of workInfographicOctober 12, 2017

It sounds like the plot of a futuristic Stephen King novel: being able to not just see your future but to change it. That could soon be a reality, at least for your finances.

In the sharing economy, where benefits and protections are diminishing, concerns are growing about the income protection gap (IPG)—the shortfall individuals experience after an income disruption due to illness or the premature death of a breadwinner.

An innovative solution exists in the very technology that disrupted those old economic certainties: a dynamic app that allows individuals to assess their financial health, accurately project their exposure to the income protection gap, and plan for their future. Deepti Sharma, who has developed digital solutions for companies including American Express and Time Inc., identified the essential elements of an app solution for income protection gaps.

Here’s how it would work:

PROFILE

Your personalized financial and wellness data, financial obligations and long-term objectives, used to inform all functions of the app.

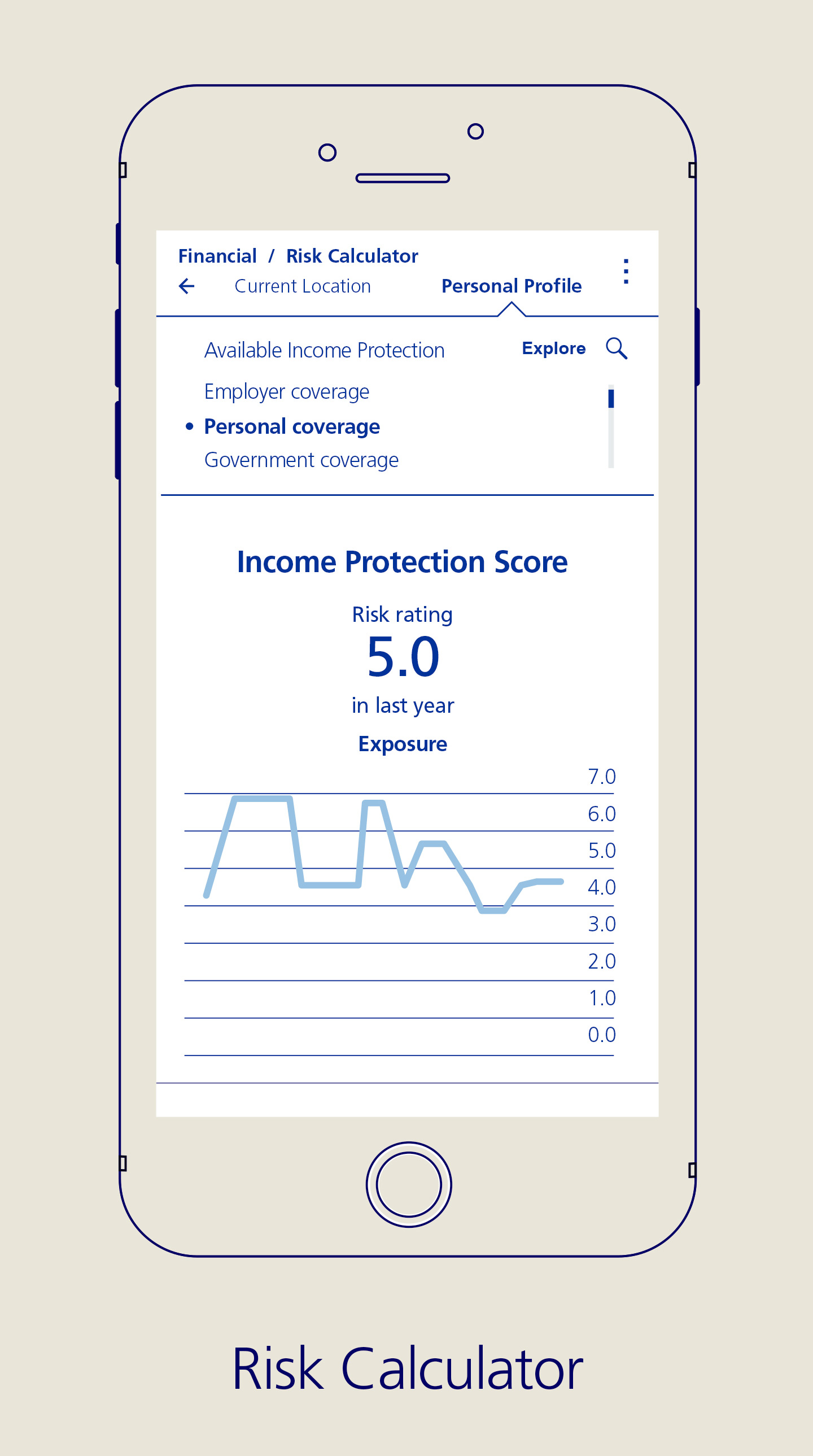

RISK CALCULATOR

The geo view details government program protections available in your location. The personal view uses your personal data to graphically project your exposure in a wide range of scenarios involving income disruption, while incorporating all public and private sources of income available.

NUDGES

Notifications help you make the right decisions required in managing dynamic personal finances, from enrollments to contributions to reminders—all designed to avoid unfavorable default options and avoidable penalties.

SOLUTIONS

Transparent analysis of IPG coverage and its costs, coupled with curated advice on effective strategies for other financial products, such as credit card rates, health insurance, etc. Includes a "Will It Work For Me?" quiz that analyzes products and policies based on your long-term objectives.

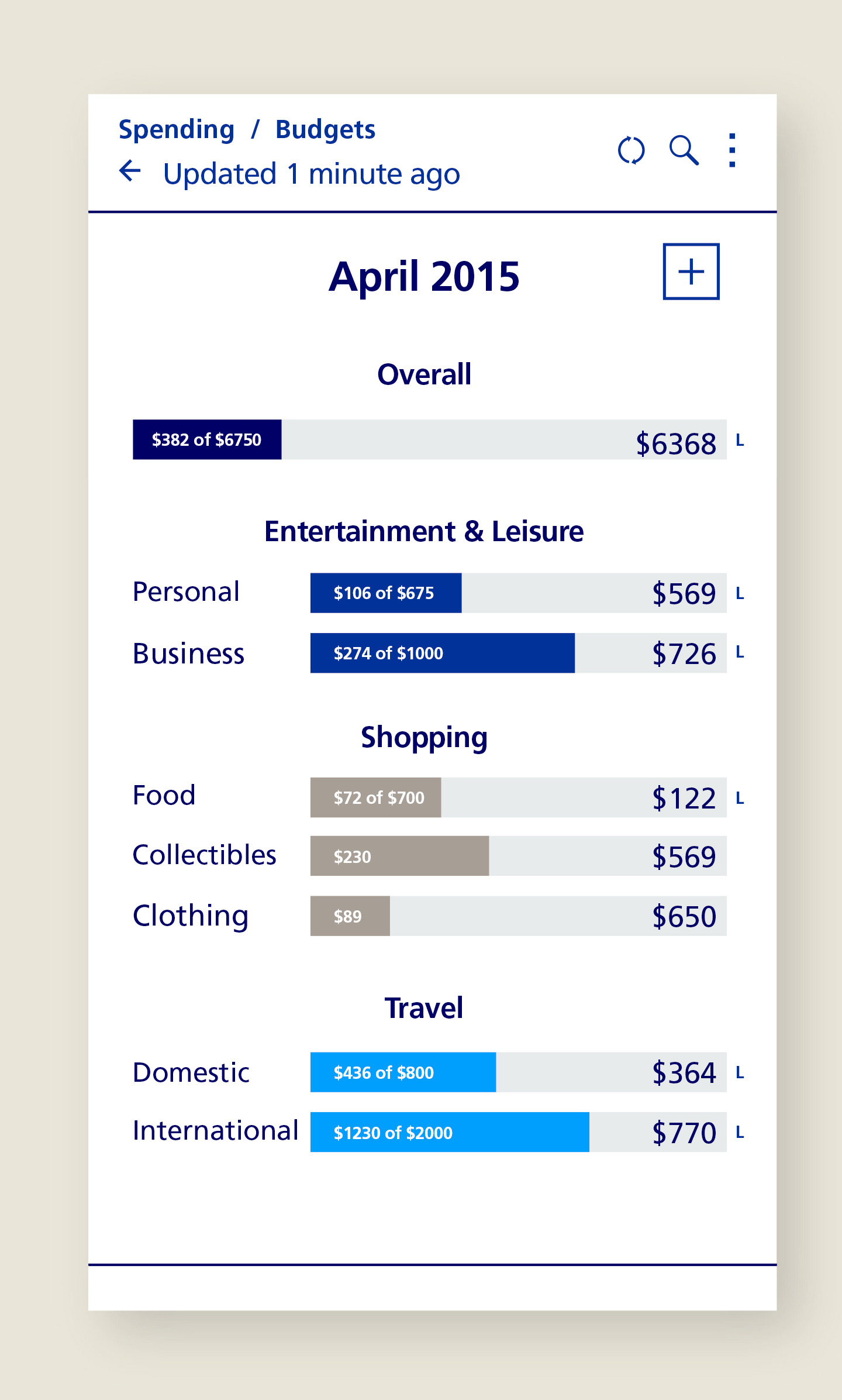

BUDGET TOOLS

Create a household budget linked to your primary bank account, with categorized expenses. Facilitates artificial-intelligence analysis on possible efficiencies in the event of income disruption.

REWARDS

Collates all incentives and savings earned via financial decision-making, private sector partnership programs and wellness plans. Permits companies to offer personalized incentives based on your activity and goals.