Supporting transitions and scaling sustainable solutions

We believe insurance can make a significant contribution to the change required to achieve the low-carbon transition. We work with customers and collaborate with public and private organizations to develop innovative solutions that enhance resilience and help prevent or minimize damage and harm from climate-related perils.

Our insurance and risk management solutions are developing with the release of new technologies, business models and approaches that are needed to achieve a climate-neutral economy.

By investing responsibly and thinking long-term, the Zurich Climate Focus Funds support the move to a low-carbon economy. These funds are available to customers in nine countries. Learn more here.

We consider customer experience at the core of our claims management, ensuring we offer a transparent, personal, and responsive service. We continuously listen to feedback, driving improvements and fair outcomes for our customers.

Our Global Claims Blueprint guides excellence and integrates sustainability into every process, empowering customers with clear choices. Across regions, including countries like Brazil, Spain, and Malaysia, we promote sustainable repair practices through trusted collaborations and responsible operations. Education is central to our approach. In 2024, our claims teams engaged customers and brokers in the UK, Mexico, Australia and France on ESG topics, such as climate resilience and forever chemicals, sharing expertise and supporting the shift to sustainable practices. By embedding sustainability into our claims proposition, we enable customers and partners to make informed decisions, helping to build a brighter, more resilient future together.

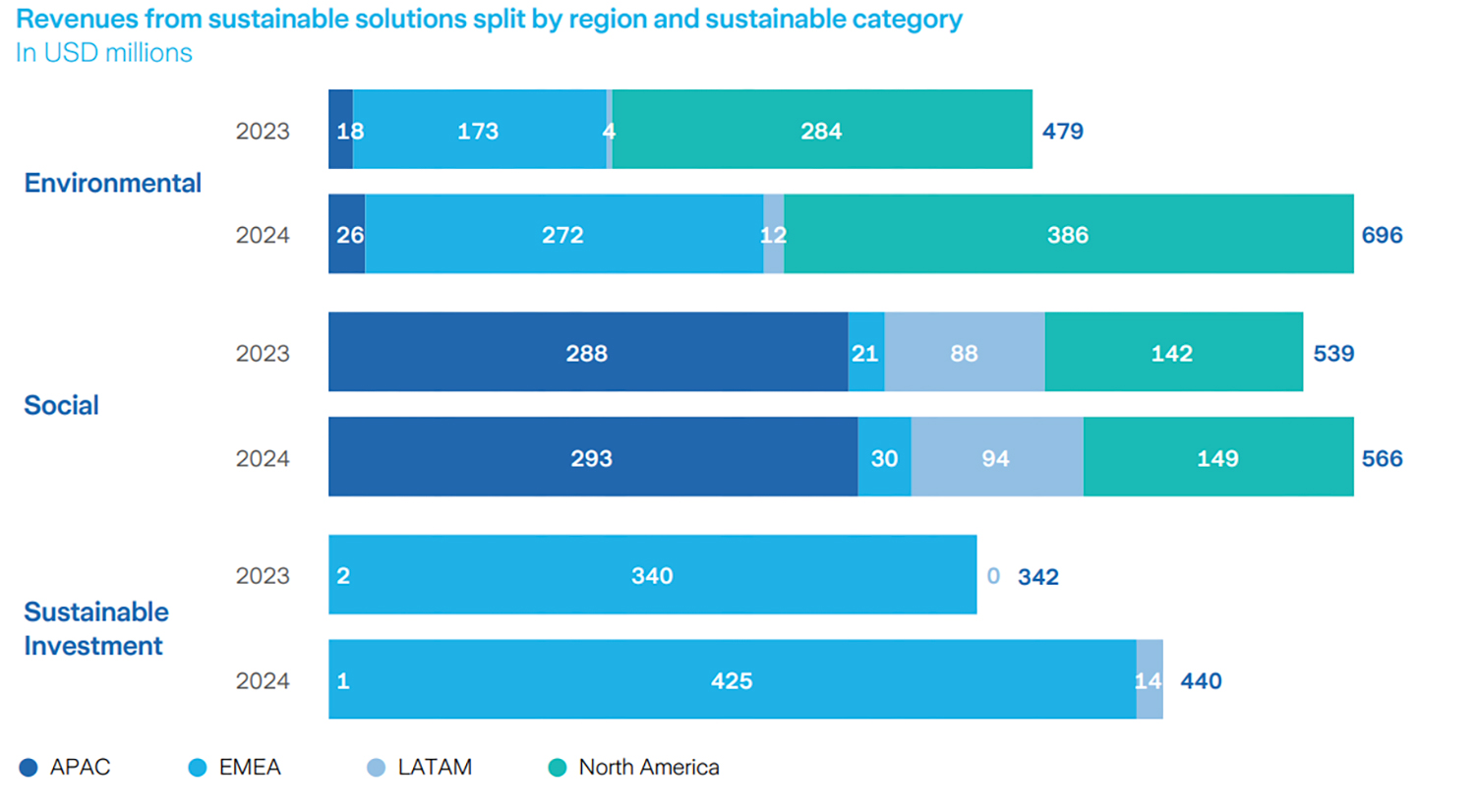

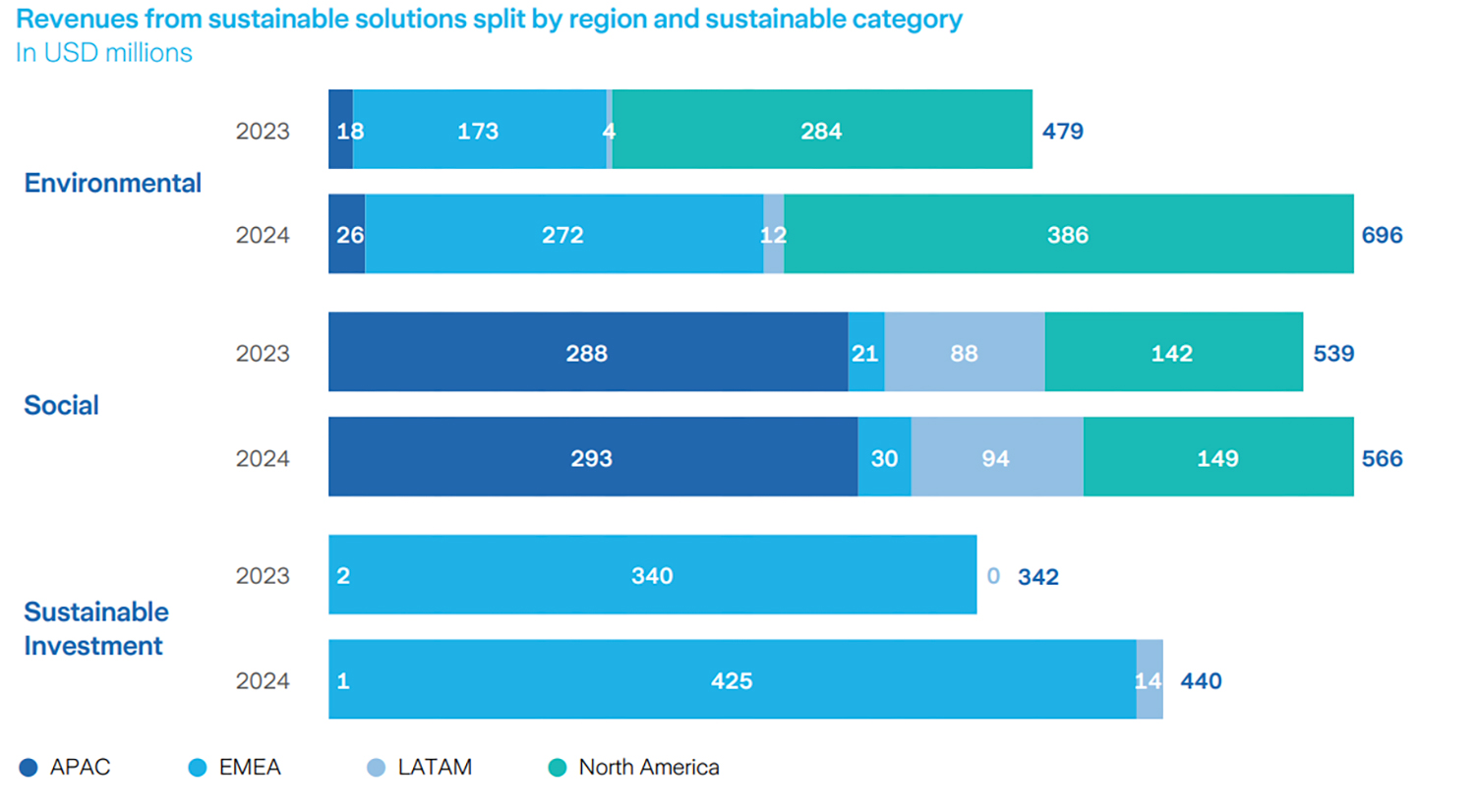

Sustainable solutions meeting our internal criteria generated USD 1.7 billion in revenues (2 percent of our total gross written premiums, fees and net flows) during 2024 (USD 1.4 billion in 2023) an increase of 25.2 percent. We continue to strive to create new solutions that help our customers on their journey to becoming more sustainable.

Since 2023, we have increased the number of approved solutions across our environmental, social and sustainable investment categories from 335 to 402 in 2024, mainly driven by our environmental category with 41 new solutions approved.

Revenues from sustainable solutions split by region & sustainable category

Several products incentivize health, safety, and/or environmentally responsible actions/behaviours for our customers. Here are some examples:

Our car cover insurance in Chile rewards customers for driving less through a variable pricing scheme. This initiative helps reduce emissions while encouraging alternative mobility solutions and keeping premiums low.

Our extended warranty solution in Germany encourages customers to repair electronics instead of replacing them. This approach reduces carbon emissions by avoiding unnecessary production and shipping of new devices, supporting a more sustainable, circular economy.

Zurich Australia is now the preferred EV insurance provider for Tesla customers in Australia through the 'InsureMyTesla' offering, accessible via the Tesla app. This collaborationunderscores Zurich's commitment to sustainable insurance solutions and its expertise in the growing EV market. Zurich has partnered with Tesla in Switzerland since 2016. We are committed to driving a sustainable future, investing in cutting-edge technology, and delivering top-tier products and services to customers.

In our North America commercial business, two new repair vs replace solutions for warranties were launched, one appliance warranty product (a service contract, where repairing the product has priority over replacement.) and one home warranty solution (uses the most resource-efficient (e.g., energy star rating) appliances to replace broken ones.)

Climate Resilience by Zurich Resilience Solutions (ZRS)

Climate change is the most pressing business and societal challenge of our time. With the world experiencing severe weather events with increasing severity and frequency, it is becoming more important for organizations to tackle the present day and future climate risks confronting them. Additionally, organizations must fulfil the growing obligations and expectations, from both regulators and society at large, to identify, manage and report on their climate risks in order to demonstrate their business resilience and economic sustainability.

The ZRS team works with organizations around the world to build resilience against the present and future impacts of climate change. As our specialized risk advisory business, ZRS helps organizations identify, assess and adapt to risks such as climate change. For example, we worked with the City Council of Madrid to identify and quantify its exposure to short- and long-term climate risks, particularly with regards to extreme heat and its impact on people. By better understanding the likelihood of an extreme heat event, and the severity of its impact, the City Council is able to prioritize the adaptation measures required to reduce risk and make its city safer.

We believe that understanding exposure to climate risk is an essential step for our customers to protect their business, assets and people. In 2024, ZRS launched Climate Spotlight, an interactive digital solution to help organizations assess their exposure to climate risks up to the year 2100. It is available through two customer products, Climate Spotlight Core and Expert, which have been designed to meet the needs both of mature and young organizations with varying priorities, resources and budgets to tackle climate-related risks. Both products provide a present-day and future-looking climate risk analysis which is accessed via an intuitive dashboard and downloadable risk report, providing insights that can be used to inform climate adaption decisions and complete climate risk reporting. This analysis leverages our proprietary climate data, which is developed using the Intergovernmental Panel on Climate Change (IPCC) scenarios. This data is used by our insurance, operations and investment business, and is consistent with the hazard view used in the calculation of our solvency position for the natural catastrophe risk as part of the Swiss Solvency Test calculation.

We combine these state-of-the-art analytics with on-site risk assessments from climate risk specialists, to provide practical recommendations organizations need, in order to adapt their physical assets and on-site operations to climate change. For example, working with a global logistics company, our climate risk experts undertook climate risk assessments at critical port terminals. The outcomes fed into the terminal’s maintenance schedules and potential investments into upgrading physical resilience measures on key infrastructure.

This end-to-end approach from portfolio-level risk analysis, down to location-based risk assessments, is a key differentiator in the market and supports customers with site adaptations as well as their climate-related reporting

obligations.

How WTP Protects Every Step of the Journey

World Travel Protection (WTP), a cornerstone of our travel insurance and assistance business, provides comprehensive travel risk mitigation as well as medical and security assistance services for leisure and corporate travelers. From pre-trip intelligence briefings and real-time alerts during geopolitical events, natural disasters and other risks, to medical evacuations and access to doctors and hospitals, WTP helps to keep travelers informed and supported every step of their journey. In 2024, nearly 38,000 real-time alerts were generated, over 137,000 cases managed and 1,350 evacuations were conducted resulting in safer and healthier travelers. These services are delivered through security personnel and practicing clinicians supported by leading technology and a robust global network of 85,000 providers in our global command centers, which operate 24/7.

Empowering Customers Through Digital Innovation and Financial Insights

Zurich Integrated Benefits & International Life continues to enhance the customer experience through digitization, increasing accessibility and financial wellbeing. In the Middle East, the MyZurichLife app allows customers to easily and securely manage their insurance and helps financial advisers provide quick support, fostering close and trusted relationships. As a result of consistent positive feedback, additional services are being introduced – notably the new Zurich Digital Advice tool, which uses advanced data analytics to help customers simulate future scenarios and build a holistic plan to achieve personalized financial goals within an hour. Accurate data and timely insights enable customers to simplify complex financial choices and make informed decisions confidently.