It’s time to invest in our greatest asset: people

PersonalArticleDecember 3, 2025

The latest results from the World Economic Forum’s Executive Opinion Survey show that societal challenges – from pensions to public health – are fast becoming boardroom priorities.

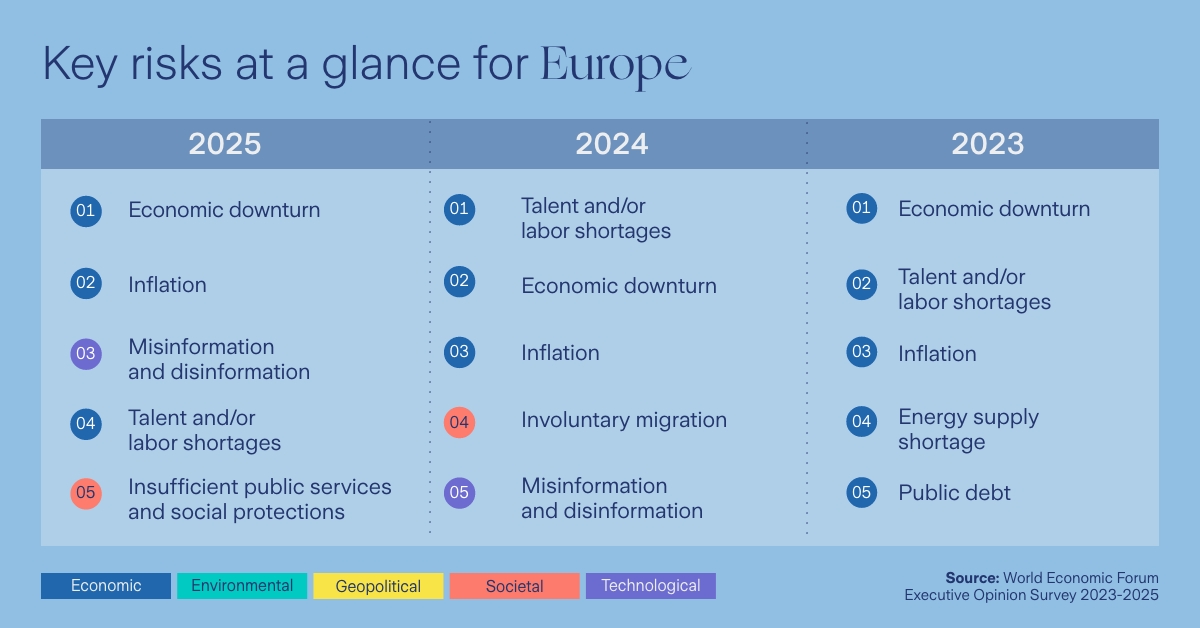

For the third year in a row, European business leaders are dealing with a complex mix of economic challenges. The latest Executive Opinion Survey (EOS) from the World Economic Forum (WEF) – reflecting the insights from more than 11,000 leaders across 116 economies – confirms the looming risk of an economic downturn remains the top concern across Europe. At the same time, inflation and talent shortages remain firmly among the top five risks.

But what’s most striking about this year’s results is a renewed focus on risks to our most important asset: people. Business leaders are turning their focus to the societal fall-out of this persistent economic turbulence, putting longer-term human capital concerns front and center. Alongside talent shortages, there’s growing anxiety about inadequate public services and social protections – including education and pensions. In several European countries – Italy, France and Germany – health and wellbeing concerns have also intensified.

And these risks could materialize sooner than we think. Take the ratio of elderly people to the working-age population, which has increased sharply in Europe, from 26 percent in 2004 to 37 percent in 2024, meaning there are fewer than three working-age adults to support every pensioner. At the same time, more than a third of the population of the EU are not saving enough toward their retirement. Vulnerable groups – such as women, young people and those in the freelance or gig economy – are especially at risk and are often left out of traditional financial safety nets.

A shared responsibility

Challenges that were once mainly the concern of governments are having a clear, direct impact on businesses and their own long-term resilience. After all, health and public service gaps - including insufficient pension savings - affect workforce participation, productivity, and employee wellbeing. Financial insecurity can lead to higher stress, lower engagement and delayed retirement, complicating workforce planning. Moreover, these gaps undermine consumer confidence and socioeconomic stability, which in turn influence the way companies operate and grow.

As risk experts we often speak about resilience, whether that’s adapting to the changing climate, supply chain disruptions or cyber threats. Today’s risks include systemic social challenges that no company, or sector, can resolve alone – but there is a clear precedent for businesses playing a role in building more resilient societies. In fact, many of our customers and partners are proactively introducing workforce wellbeing services, investing in up- and re-skilling programs and advancing digital and financial literacy.

Building financial resilience

As an insurance company, our purpose is to help people and businesses prepare for the unexpected. Building financial resilience – that word again – is a crucial first step to empower organizations, individuals and families to withstand and adapt to these emerging risks.

Clearly, we cannot solve these challenges alone; government action is also critical. And I personally welcome, for instance, the European Commission’s drive to build a Savings and Investments Union, giving citizens the confidence and tools to invest more in Europe’s capital markets.

With our expertise, our industry is well placed to support these ambitions but to fully embrace this role, we must continuously innovate – putting consumers at the forefront when it comes to providing quality advice and ensuring that the digital transformation of our industry is a force for good. I’m encouraged to see industry leaders recognizing these issues as a shared call to action – supporting social equity initiatives and creating incentives for people to help themselves, such as innovative retirement savings products.

By investing in our greatest asset – people – we can help businesses and communities enjoy a more resilient future. And what’s more important than that?

About the data

This blog draws on early insights from the World Economic Forum’s Executive Opinion Survey, conducted across 116 economies and with more than 11,000 business leaders. Zurich Insurance Group is a WEF strategic partner.

Sources:

Old-age dependency growing across EU regions, Eurostat, October 2025

Pan-European Pension Survey, Insurance Europe, 2023