Why building resilience means addressing the elephant in the room

Global risksBlogDecember 3, 2025

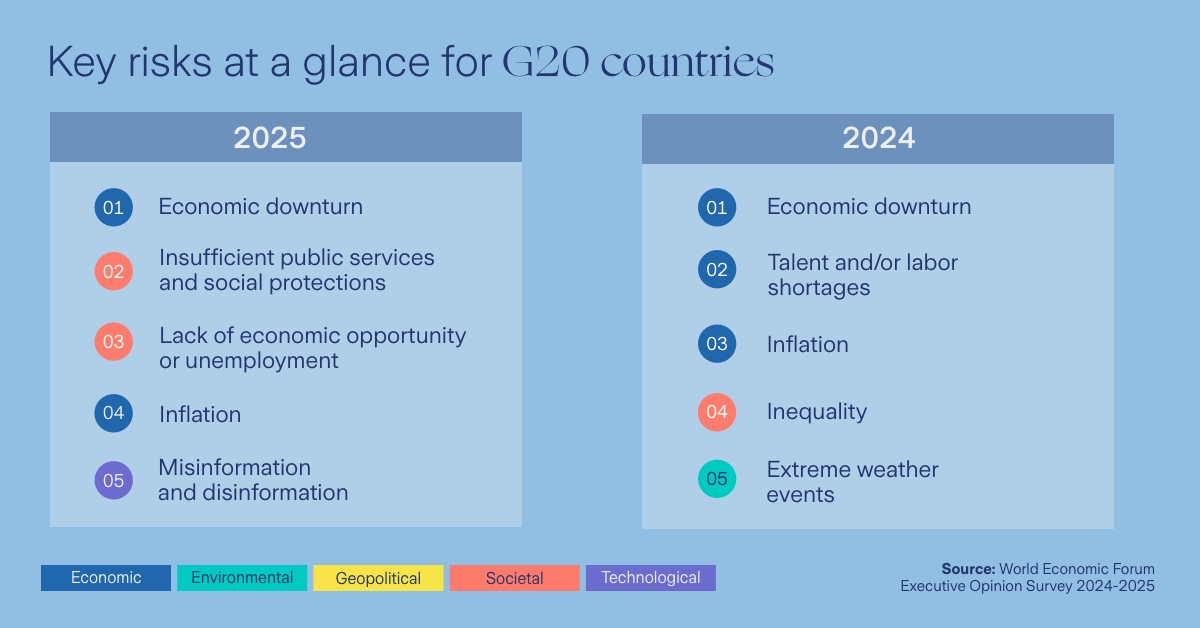

The latest results from the World Economic Forum’s Executive Opinion Survey suggest that business leaders are looking beyond the most obvious economic risks to underlying societal and technological concerns.

The greatest threat to resilience is distraction.

Of course, it’s normal to focus our undivided attention on the most urgent risks of the day, whatever they may be, but in doing so we often take our eye off gathering secondary risks and structural vulnerabilities, which can then quietly worsen and lead to yet more problems.

The latest results from the World Economic Forum’s Executive Opinion Survey (EOS) – capturing the views of more than 11,000 business leaders in 116 economies – show that executives are now turning their attention beyond imminent economic risks to include advancing societal and technological concerns.

Economic turbulence persists

Economic uncertainties remain top of mind across the G20. Although global growth has remained surprisingly resilient in the face of tariff uncertainties, the threat of an economic downturn is the top-ranked risk overall. Inflation also ranks highly, in fourth place.

These are serious and complex issues but are not fundamentally new for most risk managers. Every downturn in growth, and uptick in inflation, has its own causes – from government debt to geopolitical tensions – and with experience and within reason, their impacts ought to be somewhat manageable.

‘Elephants in the room’

But for the first time in recent years, executives across the G20 are looking beyond the most obvious risks to underlying societal and technological concerns such as failures in public safety nets, persistently high youth unemployment and misuse of AI – the true “elephants in the room.” Unlike the idiom, these risks do get their fair share of airtime, but are not urgent enough to receive sufficient attention to address them.

Why? They’re complex, shaped by long-term shifts in debt, demographics and technology. They now loom large in the two-year horizon of the EOS, but they will also persist, with structural impacts felt for years. They require coordinated action by the public and private sector – and we may not be fully prepared to tackle them.

The speed of change

To a greater extent than economic downturn and inflation, these risks present new challenges for this generation of risk managers due to the speed, scale and connectivity of change. There are no easy answers, and the challenges go beyond the immediate experience of most risk professionals.

Unemployment is a threat the world has managed many times before, but today, AI is rapidly reshaping sectors that employ 80 percent of the world’s workers. In many countries and for many generations, workers displaced by technological upheaval have been able to rely on sturdy social protections as they retrained for new opportunities. But the sustainability of public services and benefits is now under pressure from persistent debt loads and demographic divides, as working populations shrink relative to those who need support.

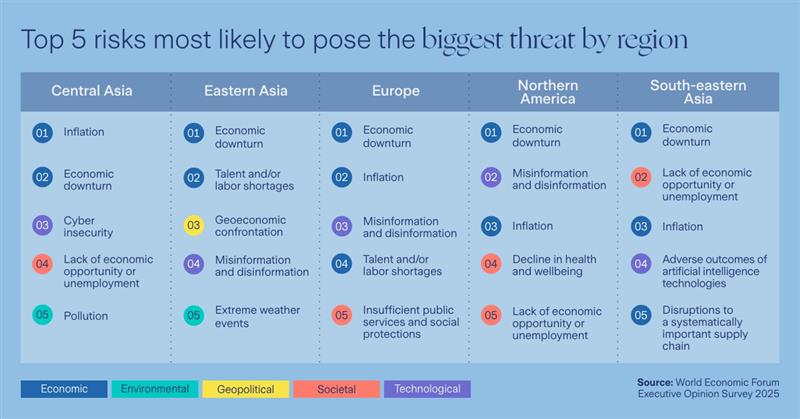

Meanwhile, the seismic structural shift in technological capabilities is not going unnoticed. While concerns might sometimes be overstated, mis- and disinformation is a top five risk across G20 countries, driven by strong concerns in regions such as northern America, eastern Asia and Europe. Southeastern Asia was the region most concerned by the adverse impact of AI, however it also featured as a top five risk in a range of G20 economies, including the United States, Saudi Arabia, South Korea, Indonesia and Germany. And for the first time in a G20 country, business leaders in Australia identified adverse outcomes of frontier technologies as a top five risk.

Time to step up

As risk leaders, we are always scanning the horizon, and right now the horizon looks pretty crowded. Social infrastructure is under pressure. AI innovation is outpacing regulation. And many countries are operating with little margin for error – politically or economically.

As the EOS results show, our most urgent risks are increasingly those that reflect deep-seated, structural factors. True resilience doesn’t come from choosing between short- and long-term thinking – it comes from integrating both perspectives into a comprehensive risk view.

This means integrating foresight into enterprise risk frameworks and ensuring that capital allocation reflects adaptive capacity – not just projected returns. It means mapping risk interdependencies. It means embedding tomorrow’s risks into today’s decision-making.

Keeping both timelines in view, even when one shouts louder than the other, is not just prudent – it’s essential.

About the data:

This blog draws on early insights from the World Economic Forum’s Executive Opinion Survey, conducted across 116 economies and with more than 11,000 business leaders. Zurich Insurance Group is a WEF strategic partner.

Sources

Jobs of Tomorrow white paper, World Economic Forum, October 2025