Q&A Rob Wyse

What impact does Zurich have on the global climate? How might

climate change affect our business? How will we mitigate the risks

and avail of the opportunities climate change presents? These are

the issues Climate and Nature Manager Rob Wyse has grappled with in

recent years. He is responsible for the Group level scenario-based

climate risk assessment process, central to Zurich’s implementation

of the recommendations of the Task Force on Climate-related

Financial Disclosures (TCFD).

Why was Zurich keen to align with TCFD as quickly as

possible?

We see climate change as one of the most complex and urgent risks

facing society. It is also a driver for many of the other risks that

we as a global insurer need to manage so it is vital that we have a

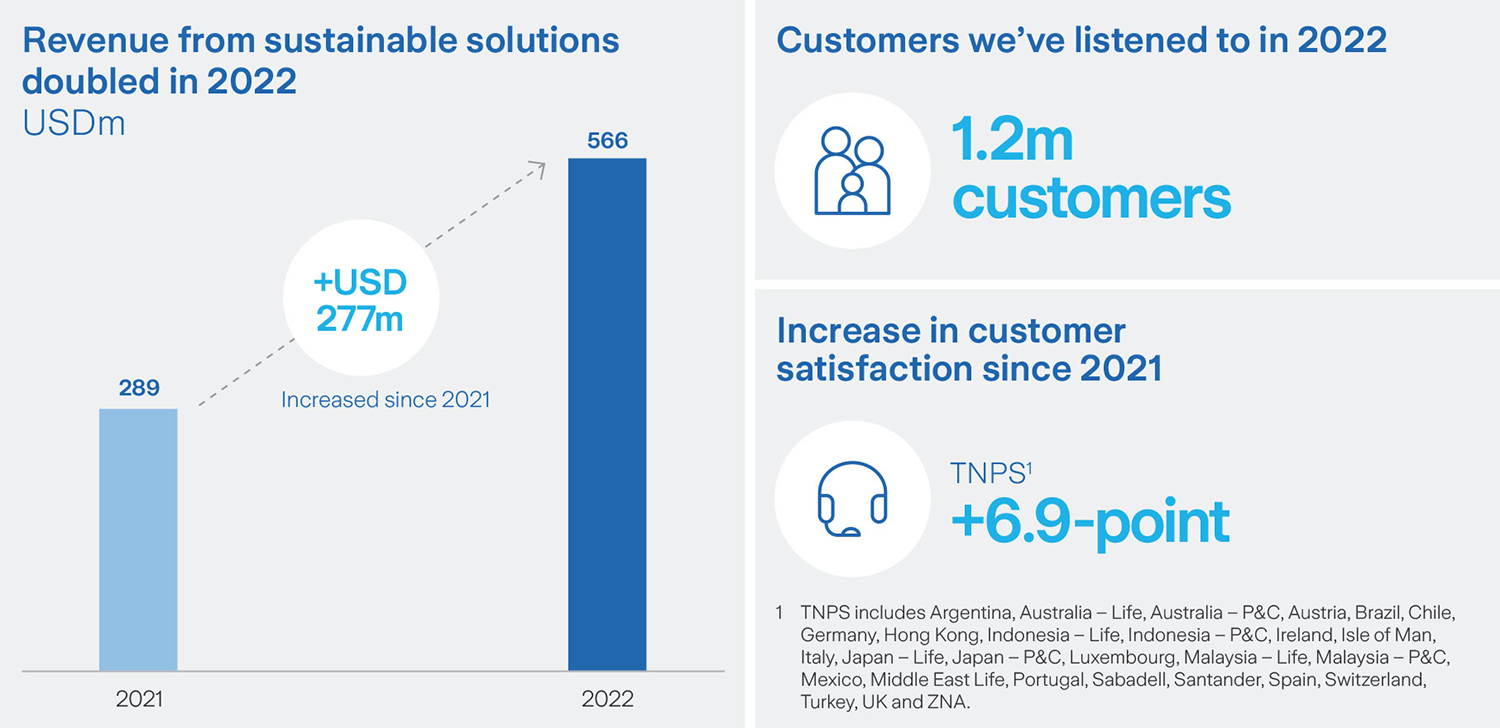

strong understanding of potential future impacts. Equally, the

transition to a low-carbon economy is a 'once in a lifetime' event.

We need to ensure we are well positioned to benefit from the

opportunities it presents.

Transparent, comprehensive and accurate external disclosure is

essential to facilitate the low-carbon transition. It is important

to us as a responsible company that we demonstrate the behaviors we

expect of our customers, peers and other economic actors.

How has the reporting evolved over the past five years?

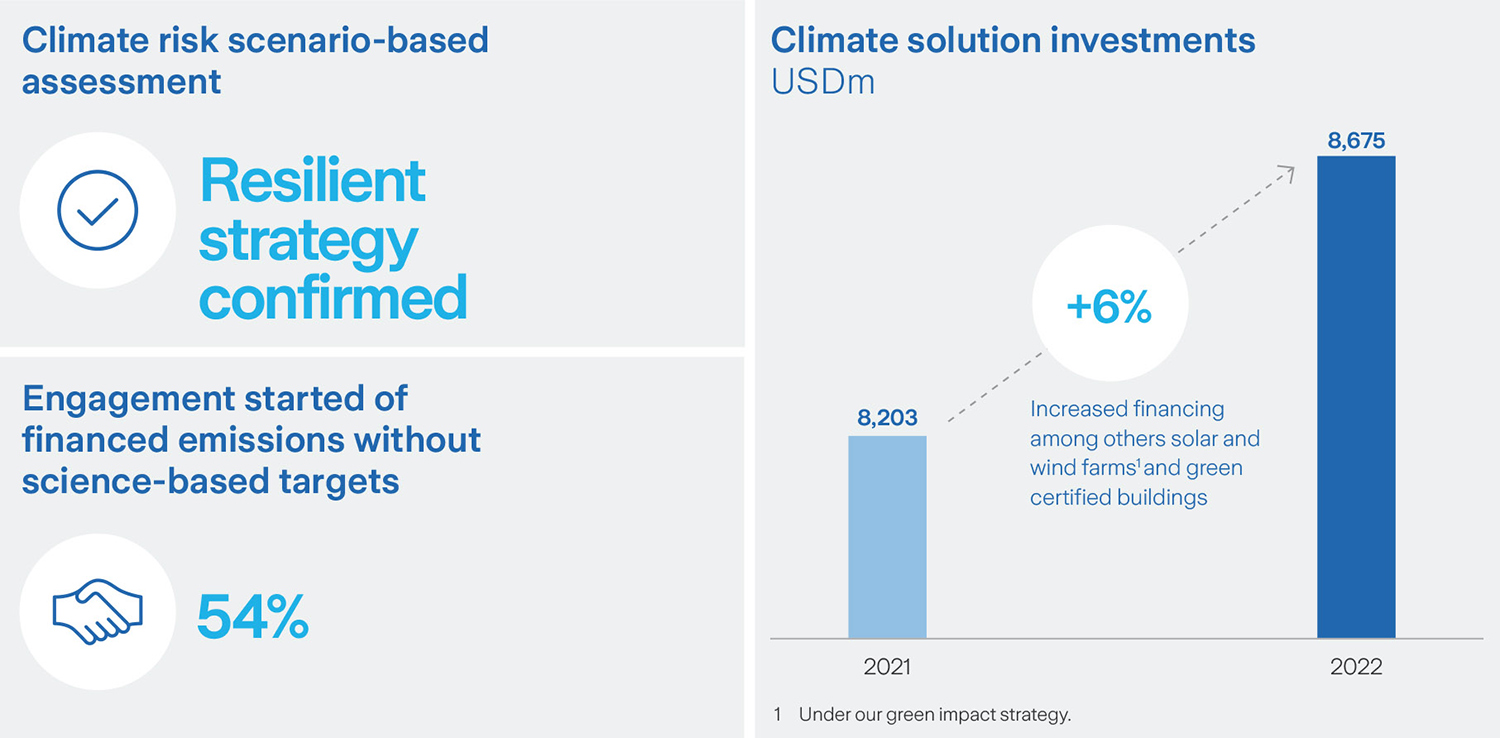

We have reported in line with the TCFD since it first published its

recommendations in 2017. Over the years our disclosures have become

increasingly more granular and detailed as our understanding of this

risk strengthens. In 2021 and in line with TCFD recommendations, we

performed our first scenario-based climate risk assessment of both

underwriting and investment portfolios as well as our operations.

What were the biggest challenges?

There have been many, but perhaps the forward-looking scenario-based

analysis was the biggest challenge. The relative immaturity of

assessment methodologies and modelling capabilities for underwriting

activities was a particular difficulty to overcome.

The quality of forward-looking analysis relies on the availability

of comprehensive, consistent high-quality data relating not only to

emissions but also to private sector climate commitments.

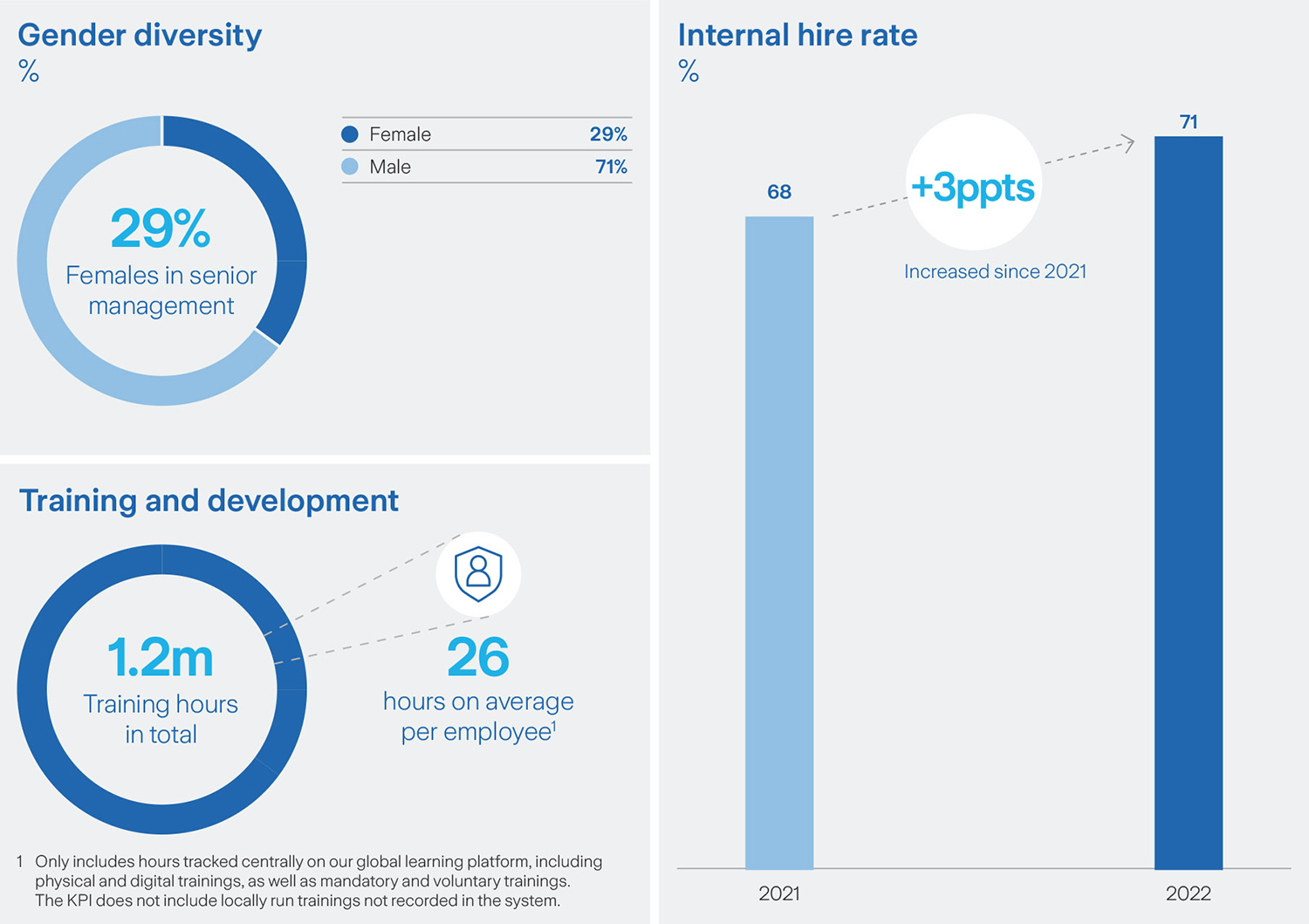

Finally, implementing these recommendations demands co-ordinated

action across all areas of the business, something that can be

resource and time intense.

How has Zurich benefited from TCFD reporting?

As a report preparer, implementing the recommendations of the TCFD

has proved immensely valuable in increasing our understanding of how

climate change could impact our business over time. Through dialogue

with subject matter experts, the nuances of scenario analysis model

outputs can be explored, leading to a more accurate and consistent

understanding of potential impacts. Scenario analysis also helps to

contextualise actions our first line business functions can take in

the short term to address potential long-term impacts.

As a report user, clear and comprehensive disclosures can serve as a

useful tool for engaging with customers to understand their

strategies for decarbonization.

What personal lessons have you learnt from TCFD?

I would encourage against viewing TCFD as a burdensome exercise.

Embrace the inherent value in understanding the climate related

risks and opportunities your organization faces. But equally so,

don’t underestimate the effort that may be required to achieve a

good level of insight. I’ve also learned that it’s more important to

ensure that your forward-looking assessment is accurate than get

distracted with precision. Don’t let the uncertainty inhibit your

efforts.