Responsible investment

We are a responsible investor

Zurich is proud to be a leading responsible investor. We believe creating long-term, sustainable value - doing well and doing good - is not only possible, but necessary. When we do ‘well’, we generate superior risk-adjusted returns for our customers and shareholders. When we do ‘good', we have a positive impact on society and the communities where we live and work. Whether it’s helping reduce CO2e emissions or helping people improve their lives, our in-house and external experts focus on improving the financial performance, transparency and positive impact of our portfolio.

Since we manage approximately USD 160 billion of own assets, by doing well and doing good, we can achieve substantial, long-term outcomes that benefit both people and the planet. We focus on three distinct outcomes: fulfilling our commitment to transitioning our investment portfolio to net-zero by 2050, as well as helping avoid 5 million metric tons of CO2e emissions and benefiting 5 million people per year through our impact investments. In 2024, Investment Management successfully met its 2025 interim climate targets and impact investing targets. These milestones mark a significant step in Zurich’s journey toward net-zero.

Our approach to sustainability strives to create value for both our company and for society as a whole

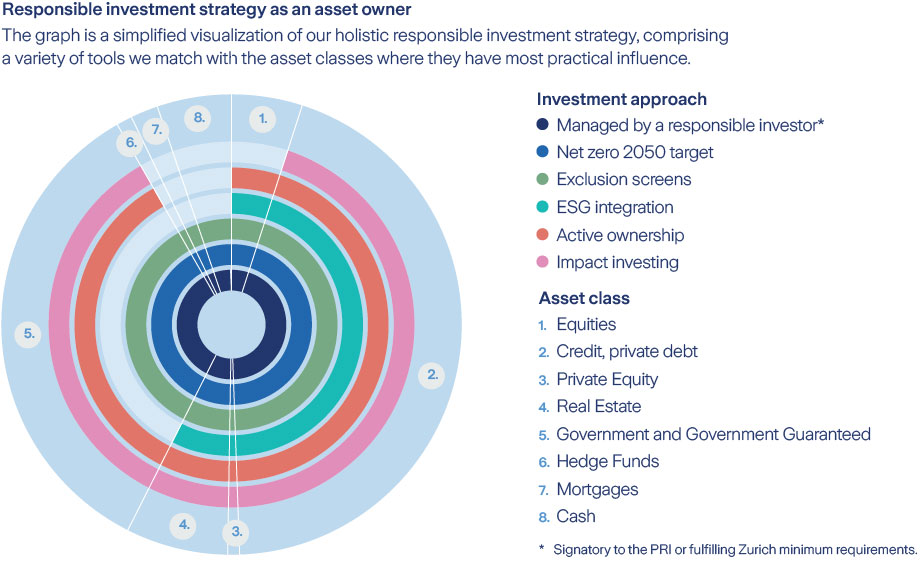

Zurich is a signatory to the United Nations-backed Principles for Responsible Investment (PRI) and the Operating Principles for Impact Management. Our comprehensive responsible investment strategy covers the entirety of our proprietary assets, matching a variety of responsible investment tools with the asset classes where they have most practical influence, and is also applicable to many of our unit-linked offerings.

Our responsible investment strategy

Responsible investment means different things to different people. There are a number of approaches and tools for responsible investment.

Zurich’s strategy comprises three core elements while consistently integrating climate action, and following a group-wide approach on exclusions:

ESG Integration

- Training

- Information

- Process Integration

- Active Ownership Integrating environmental, social and governance factors

Impact Investing

- Intentionality

- Measurability

- Profitability Making an impact by funding solutions

Advancing together

- Innovation

- Collaboration

- Public advocacy Collaborating to advance responsible investment

Climate Action

- Our journey to net-zero

Exclusions

- Read more about our group-wide exclusion policies

Awards

We are grateful and proud that our responsible investment approach has been honored with several awards.