Invest to be your best

Lesson 6

Investing is like giving your money a job — putting it to work rather than leaving it idle. Many individuals save with the hope of reaching significant life goals: securing a comfortable retirement, buying a home, funding children’s education, or planning for future healthcare needs. Often, people prefer to save rather than invest because saving feels safe and immediate.

The challenge with this is that savings alone may not be enough. Over time, inflation erodes the value of money, so the same amount saved today will buy less in the future. For instance, with an average inflation rate of 3% per year, the purchasing power of money diminishes gradually: $10,000 saved today would be worth about $7,400 in real terms after 10 years, and over 20 years that same sum loses almost half of its value.

By contrast, investing offers a way to preserve and potentially grow the value of your money. If you earn 3% a year from investing instead of losing 3% a year to inflation, $10,000 could grow to around $13,400 over ten years, rather than shrinking to $7,400. Despite this, many people hesitate to invest — often because they focus too heavily on short-term losses and their immediate financial situation.

There are two key psychological reasons that explain why many people choose saving over investing, even when investing could better protect and grow their wealth over time: loss aversion and present bias.

1) Loss Aversion: Avoiding Pain More Than Seeking Gain

We are naturally wired to dislike losses more than we enjoy equivalent gains. In other words, the pain of losing $500 feels stronger and more memorable than the pleasure of gaining $500. This imbalance in how we experience outcomes can heavily influence our financial decisions.

When it comes to investing, this loss aversion can make market downturns — even small, temporary ones — feel like personal setbacks. Short-term drops in value trigger discomfort and anxiety, leading us to focus more on the possibility of loss than the probability of long-term growth. Because savings accounts do not fluctuate in value, they appear safer and more predictable, reinforcing the idea that avoiding risk is the “better” choice.

However, this instinctive avoidance of potential loss can work against us. While keeping money in cash might feel secure in the short term, inflation quietly reduces its purchasing power year after year. This means the so-called “safe” option can actually lead to a loss in real value over time.

2) Present Bias: Favouring the Now Over the Future

People also tend to prioritise immediate comfort over future benefits, a tendency known as present bias. When applied to investing, this means we often focus more on short-term market movements than on the bigger picture.

For example, if the market dips one month, the decline feels immediate and tangible, even if it is only a temporary fluctuation. We may interpret this short-term drop as a sign of poor performance and feel tempted to withdraw our investments to avoid further “losses.” This is despite the fact that, historically, well-planned, diversified investments tend to recover and grow over time.

Savings accounts, by comparison, do not show visible ups and downs, which makes them feel psychologically calmer — even if, in reality, their growth may be insufficient to keep pace with inflation.

In short, both loss aversion and present bias push many people towards the apparent safety of cash savings. While this choice may offer emotional comfort today, it often comes at the cost of sacrificing long-term purchasing power and growth potential.

A helpful way to begin is to draw parallels to other parts of life, shifting your focus from short-term risks to long-term rewards.

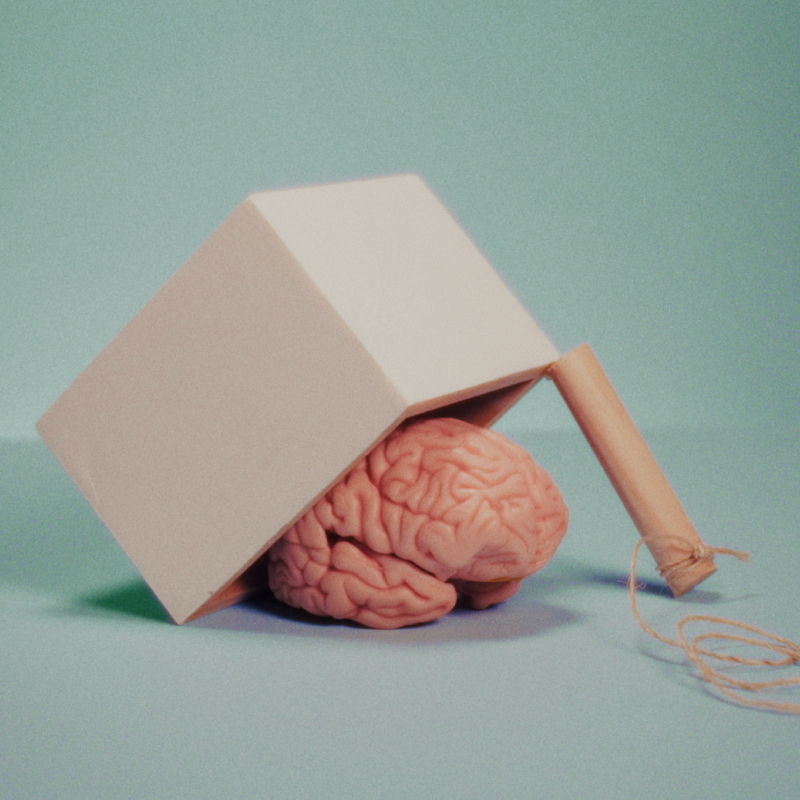

Investing is like education.

Think of investing the same way you think of school. School is full of short-term challenges — tests you might fail, grades you might want to improve — yet you tolerate those bumps because you know the end goal (graduation, a career). Investing works the same way: there will be ups and downs, but the objective is steady wealth growth over time. If we treat investing as a journey rather than a series of immediate outcomes, short-term setbacks are less likely to derail our long-term aims. So, if we think of investing as a journey, challenges shouldn’t stop us from achieving long-term financial goals that secure future well-being.

Shift from short-term to long-term perspective.

Every investment involves a trade-off between potential returns and occasional losses. When you invest, you open the door to meaningful growth opportunities, albeit with the possibility of experiencing temporary drawdowns. Despite these bumps, the long-term trajectory tends to be upward. Reframing losses as temporary parts of a longer story helps to reduce the emotional weight of volatility and makes it easier to stay invested through challenging periods.

Compare saving $10,000 over a 10-year horizon with investing the same amount in a moderately low-risk portfolio that yields, on average, 3% per year. Focusing on short-term losses might make saving feel more comfortable because it appears to avoid volatility. However, when you account for inflation at 3% per year, your cash savings would be worth only about $7,400 in today’s terms after 10 years. By contrast, investing at a 3% annual return could grow your original $10,000 to approximately $13,400 over the same period. By shifting your focus from short-term fluctuations to long-term growth, the benefits of investing become clearer.

If you’d like to start exploring investing, Zurich can guide you through every stage of the process. With Zurich by your side, you’ll have experienced advisers guiding you on your investment journey. You can be confident you’re supported by experts who help you grow your money for the future — so you can enjoy the present with peace of mind.

Remember: investing is a long-term process — like education, it requires patience, consistency, and perspective. Slow and steady growth, backed by the right advice, is often the most reliable way to secure your financial future. When you invest with purpose, you give your money a job — one that helps you become your best, now and in the years ahead.