Pension today for a better tomorrow

Lesson 8

Pensions are a little like ageing — they have a way of creeping up on you. Many people delay thinking seriously about retirement until it feels closer, but by then, valuable time and growth opportunities may have already been lost.

We all want to enjoy a comfortable lifestyle in retirement, yet pension contributions often fall short of what’s truly needed to achieve it. The reality is that saving alone is rarely enough. Without steady contributions and a focus on growth, many people risk reaching retirement with a smaller pot than they expected — one that may not fully support their future needs.

Starting early is crucial. The sooner you begin contributing consistently to your pension, the stronger the foundation you’ll build for later life. A pension shouldn’t be seen as just a backup for later life, but rather as a vital part of your overall financial strategy. With consistent contributions, your pension can provide a reliable income in retirement, covering essential living costs, unexpected expenses, and helping you maintain the lifestyle you’ve worked hard to achieve.

Zurich is dedicated to supporting your long-term financial health with a broad range of pension and retirement solutions — from personal pension plans to annuities and investment-linked options.

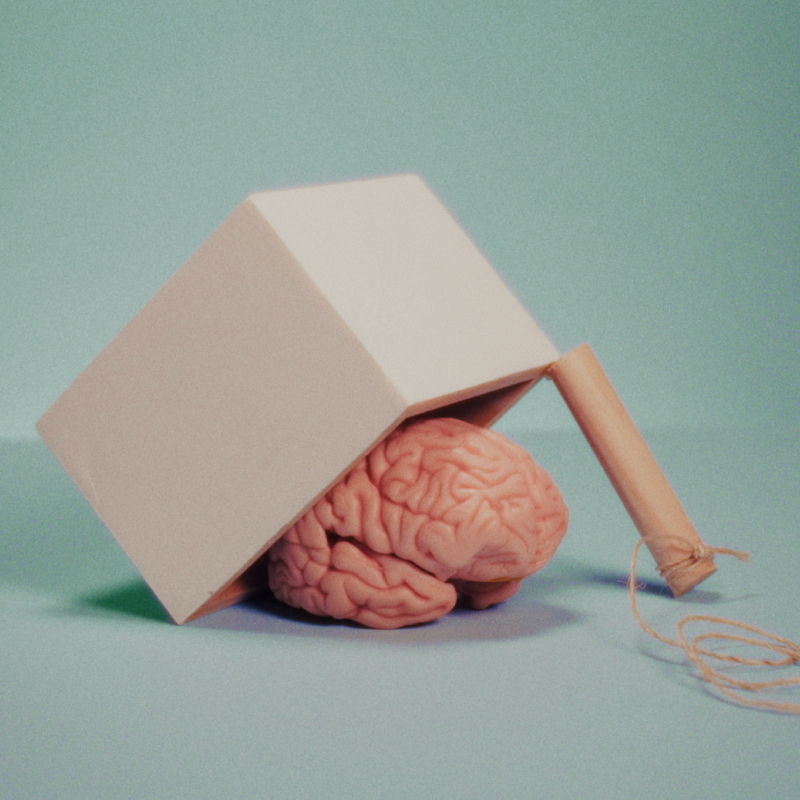

We also understand that pension planning can feel daunting. Psychological barriers often make the process seem more complicated or overwhelming than it truly is. That’s why Zurich is here as your trusted partner. With professional guidance and solutions designed to deliver stability, we aim to provide both reassurance and security — even when markets are unpredictable — so you can approach your retirement planning with confidence.

Our behavioural instincts shape how we think about money today versus money tomorrow, and these instincts can hold us back from making the decisions that would most benefit our future selves.

1) Loss Aversion

One of the biggest reasons people hesitate to increase their pension contributions is loss aversion. When we see a larger portion of our pay going into a pension, it feels like money is being taken away from us today. Even though the contribution is actually working in our favour — growing steadily for our future — the immediate reduction in take-home pay feels like a loss. And psychologically, losses feel about twice as painful as gains feel rewarding. This imbalance can make even small increases in contributions feel daunting, despite the long-term benefits.

2) Procrastination

Another factor is procrastination. The rewards of building a strong pension pot only show up years, even decades, down the line. That makes it easy to delay decisions, telling ourselves we’ll “start later” when it feels more convenient. But postponing contributions is costly. Every year missed means losing out on compound growth — the snowball effect where interest is earned not just on your contributions but also on the interest already added. By waiting too long, people miss one of the most powerful benefits of pension saving: time.

3) Anchoring to Defaults

Many workers simply stick with the default contribution rates set by their employers. These default rates are often designed to encourage participation but may not be nearly enough to secure the retirement lifestyle you want. Because the defaults feel official or “safe,” people tend to accept them without questioning whether they’re sufficient enough. This anchoring effect keeps contributions lower than they should be, limiting long-term growth.

The good news is that there are simple strategies to overcome these barriers and make pension saving feel less like a sacrifice and more like an investment in yourself.

1) Use Commitment Devices

One of the most effective ways to save more for retirement is to take the decision out of the moment. A commitment device is a tool that locks in future behaviour — for example, pledging to increase your pension contributions gradually over time. A common approach is to align contribution increases with salary rises. If you promise yourself to add 1% of your pay into your pension each year — ideally when your income goes up — you won’t feel a significant drop in take-home pay, yet your retirement savings will build steadily in the background. These small, automatic steps reduce the mental resistance to saving more and allow compound growth to work its magic over time.

2) Reframe Contributions as Future Gains, Not Present Losses

Instead of viewing pension contributions as money disappearing from your paycheque, think of them as money being reassigned to your future self. Every contribution earns interest, and then that interest earns its own interest — creating a compounding “snowball effect”. For example, if you start with $10,000 and earn 5% compound interest annually, in five years your pot could grow to around $12,762 — without adding anything extra. By starting early and staying consistent, your pension pot grows not only from what you put in but also from the accumulated growth of past contributions. Framing contributions in this positive light helps turn what feels like a short-term cost into a long-term reward.

Many people think pension saving requires large, difficult sacrifices. In reality, consistency matters far more than size.

By shifting your perspective and putting a few practical steps in place, you can build a stronger foundation for your retirement without feeling too much of a pinch today.

At Zurich, we help take the complexity out of pension planning. Our advisers work with you to create a clear plan that fits your income, goals, and timeline. With tailored guidance and flexible solutions, you can gradually strengthen your pension pot without feeling overwhelmed.

Contributing to your pension isn’t about losing money today — it’s about giving your money a job to secure tomorrow. With a steady approach, good advice, and the power of compound growth, you can look forward to your “gold age”, not just your old age.