History and heritage

At Zurich we are proud of our reputation as a leading insurer, which has stood us in good stead for over 150 years.

Throughout Zurich’s long history, our focus has been on caring for our customers and serving them. This has not changed over the years as we grew into one of the world’s leading insurance groups.

We have always sought to provide our customers with the best service and products when it matters, helping them to understand and protect themselves from risk. Our service continues to evolve as we enter new markets and develop and introduce new products.

To learn more about our history, click on key milestones in our timeline.

-

1872 Founded as a Marine Reinsurer

Zurich is incorporated under the name “Versicherungs-Verein” (Insurance Association), a subsidiary of the “Schweiz” Marine Insurance Company. Its main purpose is to write marine reinsurance for the parent company, established in 1869, and to build up a marine book of its own.

-

1874 Global from the start

Accounts in the monthly balances of the Versicherungs Verein document business relations reaching as far as New York.

-

1875 Zurich Transport & Accident Insurance Limited

Zurich moves into the new field of accident insurance, changing its name to Zurich Transport & Accident Insurance Limited. The business opportunity stems from new laws in Germany which made factory owners liable in the event of workplace accidents. By the end of the year Zurich has accident offices in Germany, Austria, and Scandinavia (Denmark, Sweden, Norway).

Innovation in Insurance

Technological (e.g. railway, cars), legislative (e.g. liability laws), business and socio-economic change are the primary drivers of innovation in Zurich’s main business accident & casualty insurance products and solutions. The emergence of the bourgeois middle classes in the 19th century and the spread of wealth to all social classes in the western hemisphere after World War II are key socio-economic forces behind a variety of new insurance needs. On the other hand, insurance itself was a force for innovation in areas such as safety engineering, medical services etc.

-

1877 Move to Brussels

A branch office is established in Belgium.

-

1878 Personal Responsibility

Zurich expands access to an emerging middle class in Germany - as microinsurance does in emerging markets today - offering a personal accident policy for workers. Such personal accident insurance is designed to meet the needs of lower-income earners, previously underserved by the industry.

Offices are set up in Paris, France and Almelo, Netherlands.

-

1879 Core principle and on-site marketing

Zurich argues in its annual report that setting premiums too low will result in unfair claims handling which in turn damages the reputation of the insurance industry. This principle is stated in the first company history in 1923 as, “No business without a sufficient premium but, on the other hand, far reaching goodwill in claims regulation.”

Zurich and Schweiz Insurance rent an office in the new Zurich Stock Exchange to offer bourse visitors a comfortable “opportunity to gain information about insurance.”

-

1880 A turnaround

Zurich quits the marine business with immediate effect after a severe loss that can only be covered using capital reserves. Heinrich Müller becomes CEO and manages the turnaround by focusing on casualty insurance and cutting the dividend. Gross premium income climbs above CHF 1 million for the first time.

-

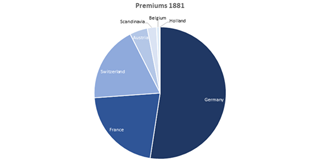

1881 Markets

The first year in which gross written premiums are broken down by country shows Germany is Zurich’s largest market, with a share of 53 percent. France follows with 21 percent while Switzerland is third with 19 percent. The rest is distributed between Austria, Scandinavia and Belgium.

An agency for Italy is opened in Milan.

-

1882 The dawn of Risk Engineering

The head of Zurich’s Frankfurt office publishes a brochure about protecting factory workers from the dangers of industrial production with a list of safety proposals. This is an early example of an insurer providing additional risk management and advice designed to reduce disruptions in production due to accidents.

Zurich introduces accident insurance for mountain guides in Switzerland, Austria and Germany.

-

1883 There when it matters

Even though the situation regarding the compensation obligation is unclear Zurich handles a catastrophe claim (11 dead, 18 injured) resulting from a fire in a French textile factory. Proving the business principles of 1879, the claim was dealt with quickly, fairly and without bureaucracy.

-

1885 Russia and Spain

Under the auspices of the Berlin office, Zurich enters Russia and hires agents in Moscow, St. Petersburg and Helsinki. The new Russian business fails to meet Zurich’s profit goal and six years later is sold to a local company. This and the establishment of an general agency in Barcelona, Spain, in December 1884 concludes the first wave of international expansion.

-

1886 Political risk and innovation

In a setback for Zurich, workmen’s compensation is nationalized in Germany. Total gross written premiums fall for the first time in the company’s history. A year later, Zurich returns to growth as the loss in the German market is offset by growth in France and Switzerland.

Zurich introduces liability insurance in Germany. Initially this business focuses on third-party liability of factories and other industrial premises but by 1890 new products in Germany cover other liabilities, including homeowner’s/real estate liability, medical malpractice for doctors and pharmacists, hunter’s liability, private liability and horse owner’s liability.

-

1887 Insuring the Swiss military

Zurich enters into an agreement with the Swiss ministry of defense to provide accident insurance to soldiers during three-week annual training exercises. This business is intensively used for publicity - inside and outside Switzerland - but is lost when the Swiss Federation establishes a national military insurance scheme in 1893.

-

1889 Caring for employees

A fund to support Zurich employees in case of temporary illness and disability is established.

-

1892 Broker channel

Zurich signs a contract with a professional insurance broker in Belgium. It’s the first time that Zurich makes use of this channel to sell its products.

-

1894 Zurich General Accident & Liability Insurance Limited

Having not written marine insurance for 14 years and with an ever larger accident & liability book, Zurich changes its name to Zurich General Accident & Liability Insurance Limited.

-

1898 A legislative boost, cars and pensions

Zurich’s French business is boosted by new workmen’s compensation laws making accident insurance compulsory for most industries. Unlike Germany, cover is left with private insurers. Accordingly France becomes Zurich’s main market in 1900, a position it consolidates after 1905. Zurich is first (1906-1908) and second (1909-1914) largest casualty insurer in France in the years leading to World War I.

Zurich’s first printed automobile liability rate schedule is issued by the Belgian office. Car liability was modeled on liability for horse carriages. By the mid 1930s, car liability insurance became Zurich’s largest line of business in terms of gross written premium.

A pension scheme is established for Zurich’s white collar employees. Executives earning over CHF 4000 per annum are excluded as they are able to make their own provisions.

-

1900 Financial strength is the only security in insurance!

Fritz Meyer replaces Heinrich Müller as CEO. He is remembered as “Reserves Meyer” because of his focus on establishing Zurich’s financial strength. By 1909, the ratio of reserves to premiums exceeds 150 percent for the first time.

Zurich takes up burglary insurance as ever widening classes of society are able to acquire valuable possessions needing protection.

-

1901 The most beautiful business premises

The construction of the new Head Office at Mythenquai 2 in Zürich is completed. The weekly chronicle of the City of Zürich writes:

None of the larger companies domiciled in the city of Zürich have nicer and more beautifully situated business premises. … The splendid new Home Office [constructed in 1899 and 1900] of Zurich corresponds to its business. In regard to territorial expansion and premium volume it takes the first place among the P&C companies on the European continent.

-

1905 A legislative boost and a rule of sound business

New laws are introduced in Italy and Belgium making accident insurance for workers compulsory. Like the French law of 1898 they leave the insurance with private companies.

Jakob Zubler develops a new re-underwriting rule that provides a secure method to check the ten thousands of risks making up the workmen’s compensation book.

Instead of automatically canceling all loss-making policies, Zubler deduced that a workmen’s compensation policy should be cancelled, or its premiums augmented, as soon as the small claims reported on it were found to be claiming more than 50% of the net premium.

-

1912 Into the New World

In December, Zurich gains the necessary licenses to start business in the U.S. By the end of its first business year, the American business already makes up 9% of Zurich’s overall premium income.

Seven years later, in 1920, the U.S. is Zurich’s main market, accounting for 50 percent of its overall gross written premium.

The decision to establish a business in the U.S. was largely due to a report by August Leonhard Tobler, a 12-year veteran of the company who had managed the Spanish and Italian operations.

-

1914Going the extra mile

Zurich uses its international network to facilitate the exchange of written information between customers who have become prisoners of war during World War I and their relatives.

-

1915 First acquisition of an entire company

For the first time, Zurich purchases an entire company, Barcelona-based Hispania Compania General de Seguros. Hispania’s stocks were bought at a discount as the company was in financial distress. The deal is engineered by August Leonhard Tobler.

Buying companies in trouble at a discount and restructuring them becomes one of the growth strategies Zurich uses throughout the 20th century.

-

1917 Accident insurance in war

The experience of the war promotes ideas for new products: Accident insurance for soldiers serving behind the front; insurance against accidents with mines and bombs.

-

1922 Remaining and expanding internationally, Life insurance and new accident products

While most competitors concentrate on their home markets after World War I, Zurich uses its financial strength and international experience to further expand internationally. It enters the UK general insurance market as the first foreign insurance company to write direct accident business.

Zurich starts the VITA Life Insurance Company in Switzerland to absorb the defaulted Swiss portfolios of German and French companies bankrupted by post-war inflation. VITA quickly expands using Zurich’s network and 1930 has its own organizations in Belgium, Germany, the Netherlands, Spain and France.

Zurich introduces accident insurance for children and designs its first surety product to guarantee builders’ contracted obligations.

-

1923 Canada

A branch office is opened in Canada.

-

1924 Tobler’s acquisitions

Under the leadership of August Leonhard Tobler – first as CEO and then as Chairman of the Board - Zurich expands during the 1920s and 1930s, mainly by acquiring and founding companies, such as:

- 1924 Acquisition of Lancashire and Cheshire Insurance Company in UK;

- 1928 Acquisition of Kosmos Insurance Company in Vienna, Austria, and Deutsche Allgemeine Insurance Company in Berlin, Germany;

- 1929 Zurich Fire Insurance Company of New York is founded. The purpose is not to write property fire business but to be able to grant fire cover for cars as part of car-hull insurance.

-

1925 The Ford Scheme & free medical check-ups

In a partner marketing agreement, Zurich becomes the official insurer for all newly-sold Ford automobiles in the UK. By the end of 1926, premium income from the “Ford Scheme” is GBP 60,000, about 50 percent of Zurich’s total premium income from the UK. It was the first time a contract offering a premium discount had been linked to a specific product and helped Zurich break into a major market dominated by local companies.

The VITA life insurance company becomes the first life insurance company on the European continent to introduce free medical check-ups for its customers, an idea first established in the U.S. By 1928 a customer periodical The VITA Adviser is introduced to promote healthy lifestyles.

In the mid-1930s VITA introduces benefits for preventive surgery. In 1968, VITA introduced standardized jogging and exercise courses. The idea is an instant success and VITA Parcours are built all over Switzerland and Austria.

-

1928 Not merely by accident

The British insurance press affirms Zurich’s world leadership in accident insurance:

The Zurich is the largest purely accident insurance company in the world, and is well known in all parts of the continent of Europe and the United States and Canada as a specialist office on the accident side of the business. (The Policy)

There are but few offices which can show so vast a spread of business, derived from accident sources alone, as the Zurich General Accident & Liability Insurance Company, the great strength of which appears to be in its reserves for outstanding claims, which indicates a high degree of prudence in providing for uncertain liabilities. This is particularly wise in accident insurance, where continuing liabilities are not uncommon. (Post Magazine)

-

1930 World economic crisis, acquisitions and the dawn of electronic data processing

The world economic crisis in the aftermath of the Wall Street Crash of 1929 has a sharp impact on Zurich’s premiums but its financial strength helps Zurich navigate the turbulence.

There is enough capital for Zurich to make further acquisitions and foundations:

- 1930 Acquisition of controlling interest in Merkur Insurance Company in Prague, Czechoslovakia;

- 1935 Acquisition of Bedford Insurance Company UK and Holmia Insurance Company in Sweden; foundation of Abri Insurance Company in France;

- 1938 Acquisition of La Nation life, non-life and reinsurance companies in France; foundation of Turegum Insurance Company in Switzerland;

- 1939 American Guarantee and Liability Company founded in New York

Accounting and controlling at Corporate Centre are converted to Hollerith punch card machines after having been done manually for 58 years since the foundation in 1872.

-

1933 Insuring on the world stage

Zurich is awarded the leading contract of the liability insurance program for the 1933 World’s Fair in Chicago.

-

1935 Meeting the needs of women

Zurich introduces a special accident insurance for women.

-

1941 Come into the Safety Zone!

Zurich U.S. introduces its Safety Zone Program aimed at improving safety standards at insured factories, especially those involved in defense production during World War II.

-

1945 Well positioned

Zurich’s global reach, and particularly its strong presence in North America, leaves it well positioned in the post-war period. The boom in the Western Hemisphere helps fund the reconstruction of the businesses in the war-ravaged countries.

-

1946 Messieurs, on continue!

Workmen’s compensation is nationalized in France, Zurich’s third largest national market in terms of gross written premium. In 1945, workmen’s compensation made up 74% of gross premiums in France. Executive Chairman Robert Matthias Naef responds by traveling to Paris and inviting all senior staff to dinner at the Ritz, where he toasts them with the phrase, “Messieurs, on continue! Gentlemen, let’s carry on!” His words become the guiding slogan for the branch.

-

1951 Morocco

A branch office is set up in Casablanca, Morocco.

-

1955 Multi-line insurer

Zurich establishes itself as a one-stop wholesale insurer and changes its name from Zurich General Accident and Liability Insurance Company to Zurich Insurance Company.

-

1961 The fifth continent

Zurich enters Australia with the acquisition of the Commonwealth General Assurance Corporation.

-

1962 India – Dangerous innovation: The Turegum scandal

Branch office opened in India. The nationalization of the entire insurance industry in 1972 forces Zurich out of India. Turegum, a Swiss subsidiary of Zurich Insurance Company founded in 1938, established a London branch to write re-insurance. It had just CHF 3.9 million in GWP on its books in 1960 but the London operation contributed GWP of CHF 100 million in 1965 and that rose to CHF 246 million in 1967.

In 1967, mounting claims and lagging premiums forced Zurich to inject capital into Turegum to stave off bankruptcy and an investigation led by later CEO Fritz Gerber in 1968 finds evidence of fraud. Worse still, the London branch had been writing the fringe business of Lloyds, risks the Lloyds brokers deemed too high to underwrite themselves. The branch manager is fired and a re-insurance specialist is brought in to restructure and turn around Turegum.

-

1965 Latin America – Marine & Contractors Insurance

Zurich finally enters South America by acquiring Iguazù Compañia de Seguros S.A. in Argentina. Zurich buys Alpina Insurance Company, one of the first public acquisitions of a listed company in Swiss commercial history. As Alpina is strong in marine insurance Zurich indirectly reenters a line of business it abandoned in 1880.

Zurich introduces the Construction All Risk policy to cover contractors of large development projects against all property damages caused by accidents or elementary forces.

-

1969 Stepping into the German insurance hub

Zurich consolidates its position in the German market by acquiring Agrippina Insurance Holding Cologne.

-

1975 Insuring international corporations

CEO Fritz Gerber initiates the establishment of the Zurich International Division (today’s Global Corporate) by asking Rolf Hüppi, who later became CEO, to develop a concept around the special insurance needs of corporations operating internationally.

-

1976 Umbrella programs

The International Division is founded. Zurich becomes the first European insurer (the second worldwide, after AIG) to offer umbrella programs to its corporate customers, which for example cover all facilities of a company worldwide.

-

1978 A new perspective on risk

Risk Engineering is founded as part of the International Division. In a world first, it provides integrated risk analyses to corporate customers going beyond traditionally analyzed property risk to include safety and liability risks. The so called Zurich Hazard Analysis tool to assess, prioritize and improve risks is developed: a genuine innovation in the field of risk analysis.

-

1980 A serious move into Asia – further expansion in the U.S.

Having opened a representative office in Hong Kong in 1973, Zurich enlarges its engagement in East and South East Asia by acquiring a minority interest in the largest Philippine insurer, the Malayan Group. The agreement includes the founding of a joint venture company, the Malayan-Zurich Insurance Company, which holds interests in non-life insurance operations in Guam, Malaysia, Singapore and Taiwan.

Acquisition of Fidelity and Deposit Company of Maryland (in cooperation with Swiss Re). Zurich Reinsurance Company of New York is founded.

-

1982 Bringing Altstadt home

Acquisition of Altstadt Versicherungs-AG in Switzerland. Altstadt was founded in 1959 by the American insurer Allstate as its first foreign operation.

-

1984 Brazil – Train the customer

Acquisition of a majority interest in Anglo-Americana de Seguros Gerais in Sao Paulo, Brazil.

Zurich Risk Engineering introduces courses for its engineers and those of corporate customers. Over eight weeks they are trained in the fundamentals of property, safety, and liability engineering, as well as the Zurich Hazard Analysis tool. The course itself is unique and the inclusion of customer representatives is a breakthrough. It not only makes customers more self-sufficient in managing their risks, but forges strong partnerships.

-

1986 Into Japan

Zurich gets an insurance license for Japan.

-

1989 Consolidation and largest takeover

For the first time, Zurich publishes consolidated Group financial statements. Zurich acquires the Maryland Casualty Group in the U.S., its largest takeover to date.

-

1991 Chile

Acquisition of a majority of La Chilena Consolidada in Chile. Acquisition of La Genevoise in Switzerland.

-

1993 Reaching out to Asia-Pacific

Zurich opens a representative office in Beijing and gets a foothold in Mainland China.

-

1996 Return to Russia and into financial services

Zurich re-enters Russia 111 years after it had done so for the first time in 1885 by acquiring a 49% stake in the industrial insurer Westrosso.

Zurich starts to realize the Allfinanz concept by acquiring over 80 percent of Kemper Corporation, with two life insurance subsidiaries and 97 percent of Kemper Financial Services. Zurich Capital Markets is founded. The company will mainly focus on alternative financing and derivative business transactions.

-

1997 Asset management

For the first time, Zurich acquires a majority interest in a purely financial non-insurance company: Scudder, Stevens & Clark, New York. Subsequently, the Kemper activities are merged into Scudder to form Scudder Kemper Investments which is later renamed Zurich Scudder Investments.

-

1998 Reaching for the stars

Zurich and the financial services arm of UK-based B.A.T Industries (Eagle Star, Allied Dunbar, Threadneedle Asset Management in the UK and Farmers Insurance in the U.S.) combine insurance and financial services activities to become Zurich Financial Services.

Through the merger with BAT Zurich is now also present in South Africa and in Sri Lanka through Eagle Star operations. The number of employees doubles from 30’000 to 60’000.

Zurich celebrates its 125th anniversary.

-

2002 Refocusing the company

James J. Schiro, former CEO of PriceWaterhouseCoopers, is appointed CEO. It is the first time that an executive from outside the company takes the top position.

After a steep drop in its share price, Zurich radically sharpens its focus as an insurance-based financial services provider. All non-core businesses are sold (IPO of Zurich Reinsurance; Threadneedle Asset management; Zurich Capital Markets), or put into run-off (Centre).

In the course of this turnaround exercise all foreign operations not reaching a certain threshold of profitability are divested.

-

2003 What gets measured gets done

Zurich announces it is on track with its ambitious goals and records significant net income.

Zurich strengthens its capital base and introduces a clear performance measure (Business Operating Profit – BOP) and restructures its investments.

The Zurich Way is launched to standardize core business processes and share best practices.

-

2005 Change happenz

Zurich launches its global brand campaign, Because change happenz, a step towards building Zurich into a leading brand and ensuring sustainable growth.

Hurricane Katrina and Wilma and the European floods offer the opportunity to concretely prove that Zurich delivers when it matters. The company remains profitable despite claims linked to these events.

-

2006 A record year

In 2006, the Group achieves record results. It reports a business operating profit of USD 5.9 billion, an increase of 48 percent over 2005, and a return on common shareholders' equity of 19 percent.

Operational transformation and profitable growth become two strategic cornerstones upon which Zurich's strength and stability are built.

-

2007 Taking corporate responsibility seriously

Business operating profit increases 10 percent to USD 6.6 billion.

Zurich establishes global initiatives to take on some of the century’s most pressing challenges: poverty, through its Microinsurance Practice, and climate change, through the Climate Office.

-

2008 Steering clear

Care and discipline help Zurich navigate the financial crisis in 2008 and the company delivers positive results and a solid investment return.

Zurich HelpPoint is introduced as a common denominator for the many advice, service and solution offerings Zurich provides for its customers. Customer centricity and people management are added to operational transformation and profitable growth to complete Zurich’s four strategic cornerstones.

Zurich enters Turkey by acquiring TEB Sigorta Insurance Company.

-

2009 Times of crisis, times of opportunities!

In a period of ongoing global economic uncertainty, Zurich closes the year with its 28th consecutive quarter of profitability. The balance sheet remains strong and solvency margins are at near-record levels.

Zurich acquires 21st Century the U.S. personal car insurance business of AIG and merges it with Farmers Exchanges.

Zurich streamlines its organizational structure to increase the company's flexibility and transparency and to enable it to manage its capital and dividend flow more effectively.

-

2010 We are there when it matters!

Martin Senn takes over as CEO.

When an earthquake hits Chile on February 27 within 24 hours a dedicated Zurich team is on the ground operating catastrophe claims handling. Zurich is among the first companies to make initial claim payments.

Zurich is included in the top 100 global brands by the Interbrand ranking for the first time.

-

2011 Global reach

Zurich reaches two notable milestones in its selective emerging market expansion. The first is the acquisition of composite insurer Malaysian Assurance Alliance Berhad.

The long-term alliance with Banco Santander is the second milestone, under which Zurich can reach a potential 36 million customers in Brazil, Mexico, Argentina, Chile and Uruguay with its general and life insurance solutions.

-

2012 100 Years insuring America

Zurich celebrates its hundredth year in the United States, and one-hundred years of helping customers there understand and protect themselves from risk. Some of the most notable projects we've worked on include the Chicago World’s Fair in 1933 and Madison Square Garden (located in New York City) in the 1960s.

A name change to celebrate what Zurich does Zurich changes its name from Zurich Financial Services to Zurich Insurance Group in order to more accurately reflect its business and the role the company plays in society.

-

2013 Zurich creates value for sustainable future

In 2013 Zurich announces a CHF 21 million five-year alliance with the International Federation of Red Cross and Red Crescent Societies to enhance community flood resilience and a five-year collaboration of up to CHF nine million with Practical Action, which will also focus on flood resilience.

Zurich presents its 2013 United Nations Global Compact report and the Z Zurich Foundation’s 2012 annual report. These reports describe some of the ways in which Zurich is helping society to better understand and manage the challenges it faces.

-

2015 Gaining an 'EDGE'

In 2015, Zurich became the first global company in the insurance industry to be certified by 'EDGE' (Economic Dividends for Gender Equality). Zurich is making progress in creating a diverse environment that brings out the best in Zurich employees and attracts the brightest talent.

Zurich also launched a Swiss-style apprenticeship program in a U.S. college near Zurich’s offices in Schaumburg, Illinois, to train the next generation of insurers. The program combines coursework with on-the-job experience.

-

2016 A more customer-oriented approach

Mario Greco takes over as Group CEO in March 2016. In July 2016, Zurich introduces a simpler, more customer-oriented approach to support global and local businesses.

On November 17, 2016, Zurich unveils a new strategy to investors, which builds on qualities that include financial strength and a trusted brand. It also sets financial targets for 2017-2019.

-

2017 Positioning Zurich in a dynamic market

Profound changes including digital advances, insurance offerings by new, non-traditional providers, and heightened customer expectations are affecting us all.

We are making sure we have the right expertise to succeed, so that Zurich is well-equipped for whatever the future brings. This includes targeted acquisitions. In 2017 Zurich acquires Cover-More Group Limited, a travel insurance and assistance solutions provider, and Halo Insurance Services Limited, a distributor of insurance related to vehicle hire.

-

2020 Zurich sponsors reforestation in Brazil’s Atlantic Forest

Responding to the outbreak of the COVID-19 pandemic, Zurich supports customers by providing financial relief through premium rebates, payment holidays and extending coverage. Zurich makes it easier for customers to report claims by video, sign documents electronically or request remote risk assessments. Often working from outside the office, including from home, employees are still able to provide a full range of services. Besides supporting local communities, Zurich provides resources to support employee well-being, and gives additional benefits to those employees hospitalized by the infection.

In September 2020, Zurich launches the Zurich Forest Project, an eight-year reforestation initiative to help restore Brazil’s Atlantic Forest by planting 1 million native trees in collaboration with non-profit Instituto Terra.

At the end of the year, Farmers Group, Inc. agrees to acquire MetLife’s property and casualty business in the U.S. together with the Farmers Exchanges, which are owned by their policyholders, giving Farmers a truly nationwide presence in the U.S. and enhancing existing channels.

-

2021 Zurich’s newly restored global headquarters

In July 2021, Zurich employees move into the newly renovated Quai Zurich Campus, near Zurich’s lakefront at the historic site where the business has been headquartered since 1900. The site is a combination of breath-taking new design, and pristinely restored historic buildings. Modern features make Quai Zurich Campus optimal for hybrid working, and meet the highest sustainability standards. The new on-site Zurich Heritage Center presents Zurich’s history and innovations with museum-quality exhibitions. The Center is open for visitors.

-

2022 Celebrating 150 years

Zurich celebrates its 150-year anniversary on October 22, 2022. Along with special programs for employees, the Group marks the occasion by offering one full day of free public transportation in the canton of Zurich. It also plans to bring the Amazônia exhibition by celebrated Brazilian photographer Sebastião Salgado to Zurich. Zurich is one of the main global sponsors of the exhibition.

-

2022 Standing united with Ukraine

Zurich and the Z Zurich Foundation work together to help people facing hardship during the conflict in Ukraine. The Z Zurich Foundation launches a campaign to support humanitarian efforts, pledging to match donations up to CHF 1 million. In just four weeks, it raises CHF 2 million including matching funds. In June 2022, Zurich sends 207 tons of food to Kharkiv. As winter approaches, it delivers nine generators and 60 stoves.

In May 2022, Zurich also agrees to sell its business in Russia to 11 members of the unit’s team.