Sustainability risk

Creating positive outcomes taking economic, social and environmental considerations into account

Regular review of sustainability issues

Sustainability issues are often systemic, complex and evolving so it is really important for companies to regularly review the materiality of these issues. Materiality defines why and how certain sustainability issues are important for a company by assessing their importance to stakeholders (both internal and external). The Zurich Insurance Group (Zurich) performs a materiality review to define our strategic sustainability priorities and what matters most to us and to our stakeholders.

What are sustainability risks?

Sustainability risks are those risks associated with sustainability issues. Like global risks, they are interdependent and often have emerging risk characteristics. They are typically drivers for other risks, long-term in nature and difficult to quantify as there is great uncertainty as to how they will develop. So, we use different techniques and approaches to understand and manage those risks.

They are often classified as being either environmental, social or governance (ESG) topics.

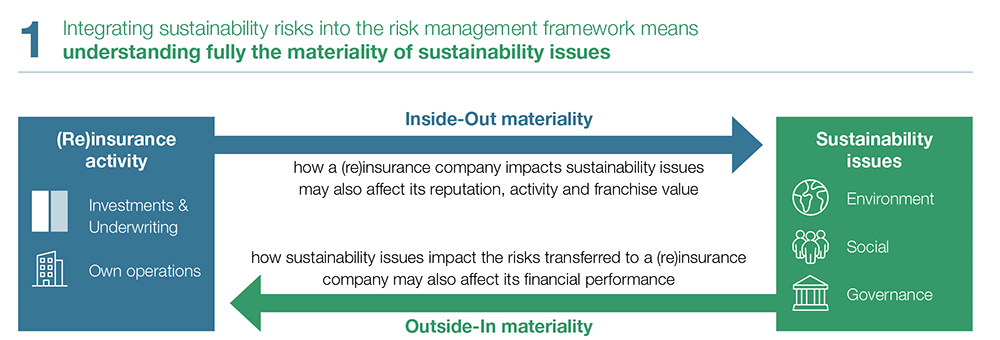

Double materiality – a way to view risks from different perspectives

It is clear that sustainability risks go beyond reputational risk and link to an insurer’s purpose and strategic goals. Work on sustainable finance in jurisdictions such as the EU has led to the concept of “double materiality” – the consideration of both how an insurer is affected by the risks related to a sustainability topic (often referred to as “outside-in” risks) as well as an insurer’s own impact on that issue (“inside-out” risks). This is a key feature of sustainability risks and an additional dimension we consider in our risk management practices.

Source: Mind the Sustainability Gap – Integrating sustainability into insurance risk management

Integrating sustainability risks into the enterprise risk management framework

This integration includes the following:

- Sustainability risk identification: is the process of monitoring topics on the emerging and sustainability risk radar to identify those topics that may develop into a material risk for the Group.

- Sustainability risk assessment: Where sustainability is a driver for other risks, responsibilities and requirements for risk assessments are defined for each major risk type (credit risk, market risk, operational risk etc.).

- Scenario analysis: For some sustainability risks, especially those with particularly long-term emerging risk characteristics and a high degree of uncertainty (e.g., climate change risks) a scenario-based risk analysis is used. For climate change risks, this includes identifying, assessing and monitoring potential climate change related risks and opportunities associated with a range of plausible future states over a time horizon that extends beyond the typical planning window. It is deployed at Group level to support strategic and risk management responses and the outcomes are disclosed in our Integrated Sustainability Disclosure (ISD) in the Group’s Annual Report. This follows the recommended frameworks of the Taskforce for Climate Related Financial Disclosures (TCFD).

- Risk response: Sustainability risks which have been identified and prioritized will often have risk positions, explaining Zurich’s appetite for these risks, as well as sustainability risk briefings which are put into practice by businesses and functions to manage the risks appropriately.

- Risk monitoring and reporting: Support is available from experts across the Group and escalation follows normal governance procedures. We track and analyze the outcome of the risk assessment and risk mitigation efforts.

Integrating sustainability risks into investment, underwriting and operations

Zurich’s general approach

Zurich supports actions, behaviors or activities that are consistent with the purpose, values and strategy of the Group.

- Zurich takes underwriting and investment decisions considering ESG criteria, aligning these criteria with Zurich’s purpose, values and strategy.

- Where Zurich enters into external commitments, it does so after due consideration of potential business implications and takes appropriate steps to deliver on these commitments to safeguard against risks to reputation, for example, through accusations of “greenwashing.”

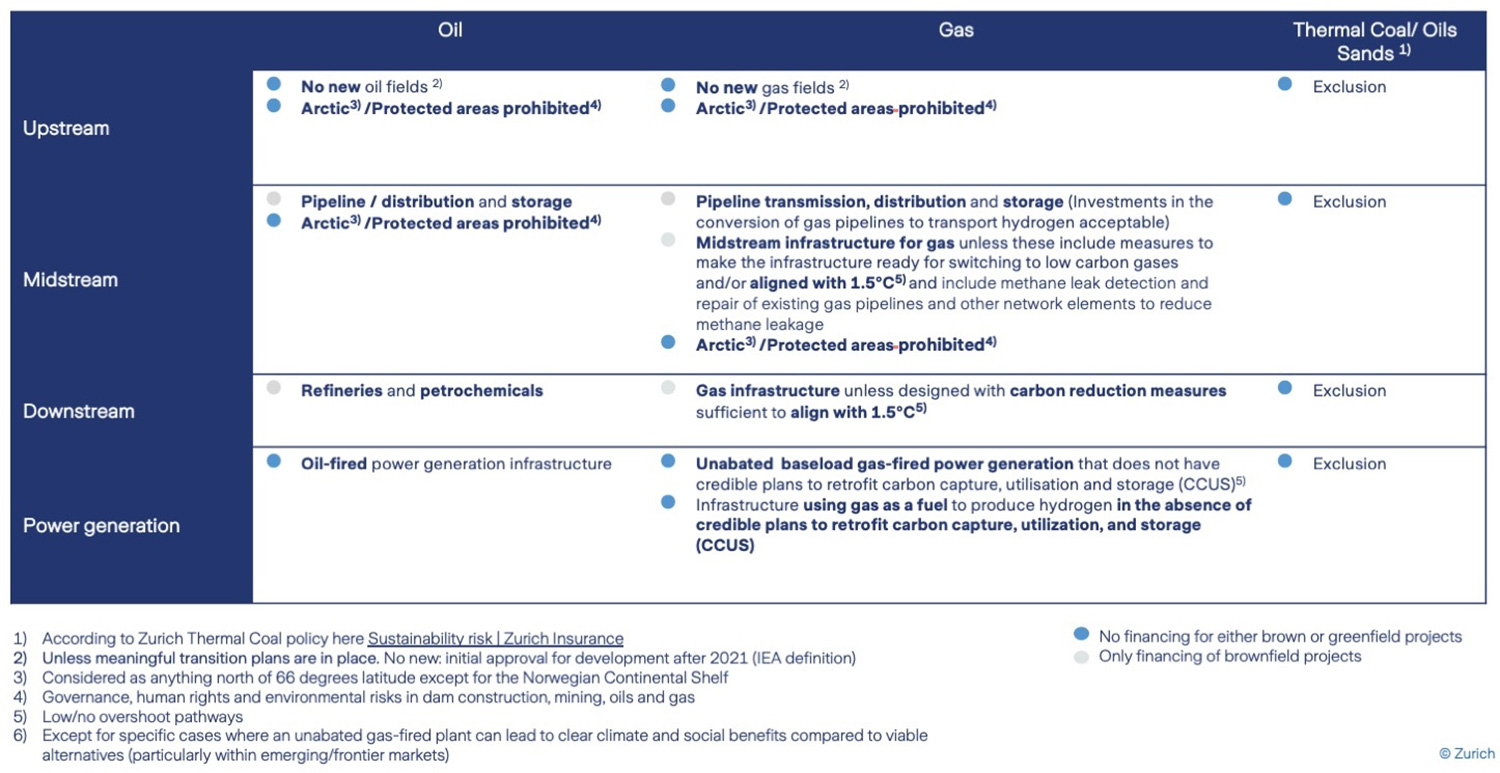

- Zurich has policies and sustainability positions in place that define the business activities for which the company has no underwriting or investment appetite.

We integrate our commitment to sustainability and the UN Global Compact in our underwriting and business decisions. Using our proprietary risk-profiling methodology, we have prioritized certain key areas of concern. For each of these, we have drawn up a sustainability issue brief that sets out our position and best practices. Our positions for two key areas of concern across the Group (including underwriting and investment management) are described below.

Sustainability risk in underwriting

Society is facing increasingly interconnected and complex ESG challenges. The insurance industry cannot be a bystander and where appropriate, it must play its role in addressing these challenges as a manager of risk. Failing to do so, can have a damaging effect on society, stakeholder trust and the reputation of the insurance industry and its customers. That is why we work with our corporate customers and brokers to better manage sustainability risks and strive to promote best practices in managing ESG risks.

We believe it is better to engage with customers to understand their business and operations and work together to ensure responsible and sustainable business practices are in place. This enables us to make better-informed decisions on how we can support customers in developing best practice.

We also provide guidance and training for underwriters and other relevant stakeholder groups and have established sustainability risk assessment and referral processes.

Zurich tracks and monitors volumes and types of sustainability risks in business transactions internally within the Group. Significant changes in sustainability performance can be monitored and assessed accordingly.

In addition to the positions followed by the Group described above, we pay special attention to the following areas of concern in underwriting:

Responsible investment, ESG integration and impact investing

We believe that proactively integrating sustainability risks and opportunities in our investment decisions will help us to do our job well on a long-term basis (ESG integration). ESG integration – across asset classes, and alongside traditional financial metrics and state-of-the-art risk management practices – helps us to achieve superior risk-adjusted, long-term financial returns. At Zurich, we define ESG integration along four basic requirements: training, data, investment process and active ownership. These four requirements not only help us to integrate ESG factors in the investment decisions, but also to understand and monitor where we or our asset managers stand in terms of capabilities.

Sustainability risk in operations

Due to the nature of our business, we are predominantly a consumer of services, and not products or raw materials. Compared with other industry sectors such as manufacturing, the risks associated with the ESG impact of Zurich's supply chain are low. Nonetheless, we are committed to effectively managing such issues. We have developed a third-party governance framework (TPGF), which provides a framework of minimum standards that apply to the onboarding and management of third parties with which we work, including suppliers. The TPGF adopts a risk-based approach to establish onboarding and management measures, such as third-party due diligence processes, that are relevant and proportionate to the nature and risk of any particular transaction. We consider supplier alignment with our Supplier Code of Conduct (SCOC) as part of our due diligence processes and request selected suppliers to complete a self-assessment. We have a referral process in place to investigate or resolve, as appropriate, any red flags identified during the due diligence process. We also use a software tool that uses artificial intelligence to screen news reports, social media posts and NGO reports to monitor potential ESG-related supply chain issues. We additionally seek to include specific provisions within our supplier contracts requiring suppliers to embrace ethical business practices. From time to time, we may conduct audits or follow-up reviews on these topics with our suppliers.